Page 4 - DMGT405_FINANCIAL%20MANAGEMENT

P. 4

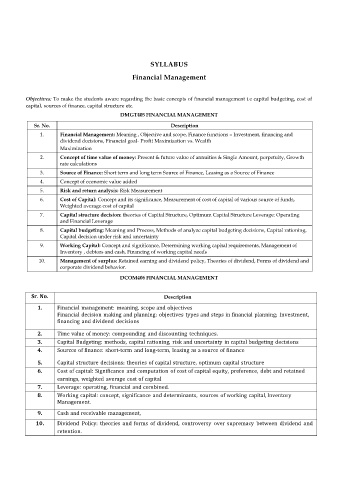

SYLLABUS

Financial Management

Objectives: To make the students aware regarding the basic concepts of financial management i.e capital budgeting, cost of

capital, sources of finance, capital structure etc.

DMGT405 FINANCIAL MANAGEMENT

Sr. No. Description

Description

1. Financial Management: Meaning , Objective and scope, Finance functions – Investment, financing and

dividend decisions, Financial goal- Profit Maximization vs. Wealth

Maximization

2. Concept of time value of money: Present & future value of annuities & Single Amount, perpetuity, Growth

rate calculations

3. Source of Finance: Short term and long term Source of Finance, Leasing as a Source of Finance

4. Concept of economic value added

5. Risk and return analysis: Risk Measurement

6. Cost of Capital: Concept and its significance, Measurement of cost of capital of various source of funds,

Weighted average cost of capital

7. Capital structure decision: theories of Capital Structure, Optimum Capital Structure Leverage: Operating

and Financial Leverage

8. Capital budgeting: Meaning and Process, Methods of analyze capital budgeting decisions, Capital rationing,

Capital decision under risk and uncertainty

9. Working Capital: Concept and significance, Determining working capital requirements, Management of

Inventory , debtors and cash, Financing of working capital needs

10. Management of surplus: Retained earning and dividend policy, Theories of dividend, Forms of dividend and

corporate dividend behavior.

DCOM406 FINANCIAL MANAGEMENT

Sr. No. Description

1. Financial management: meaning, scope and objectives

Financial decision making and planning: objectives types and steps in financial planning; Investment,

financing and dividend decisions

2. Time value of money: compounding and discounting techniques.

3. Capital Budgeting: methods, capital rationing, risk and uncertainty in capital budgeting decisions

4. Sources of finance: short-term and long-term, leasing as a source of finance

5. Capital structure decisions: theories of capital structure, optimum capital structure

6. Cost of capital: Significance and computation of cost of capital equity, preference, debt and retained

earnings, weighted average cost of capital

7. Leverage: operating, financial and combined.

8. Working capital: concept, significance and determinants, sources of working capital, Inventory

Management.

9. Cash and receivable management,

10. Dividend Policy: theories and forms of dividend, controversy over supremacy between dividend and

retention.