Page 70 - DMGT405_FINANCIAL%20MANAGEMENT

P. 70

Sales of the company 2862000

Financial Management

Out-side purchases 676800

Workers salary 104400

Bankers 836570

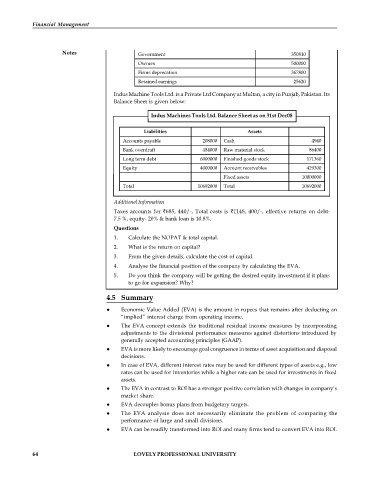

Notes Government 350810

Owners 500000

Firms deprecation 367800

Retained earnings 25620

Indus Machine Tools Ltd. is a Private Ltd Company at Multan, a city in Punjab, Pakistan. Its

Balance Sheet is given below:

Indus Machines Tools Ltd. Balance Sheet as on 31st Dec08

Liabilities Assets

Accounts payable 208000 Cash 4940

Bank overdraft 484000 Raw material stock 86400

Long term debt 6000000 Finished goods stock 171360

Equity 4000000 Account receivables 429300

Fixed assets 10000000

Total 10692000 Total 10692000

Additional Information

Taxes accounts for 685, 440/-, Total costs is 1148, 400/-, effective returns on debt-

7.5 %, equity- 20% & bank loan is 10.8%.

Questions

1. Calculate the NOPAT & total capital.

2. What is the return on capital?

3. From the given details, calculate the cost of capital.

4. Analyse the financial position of the company by calculating the EVA.

5. Do you think the company will be getting the desired equity investment if it plans

to go for expansion? Why?

4.5 Summary

Economic Value Added (EVA) is the amount in rupees that remains after deducting an

“implied” interest charge from operating income.

The EVA concept extends the traditional residual income measures by incorporating

adjustments to the divisional performance measures against distortions introduced by

generally accepted accounting principles (GAAP).

EVA is more likely to encourage goal congruence in terms of asset acquisition and disposal

decisions.

In case of EVA, different interest rates may be used for different types of assets e.g., low

rates can be used for inventories while a higher rate can be used for investments in fixed

assets.

The EVA in contrast to ROI has a stronger positive correlation with changes in company’s

market share.

EVA decouples bonus plans from budgetary targets.

The EVA analysis does not necessarily eliminate the problem of comparing the

performance of large and small divisions.

EVA can be readily transformed into ROI and many firms tend to convert EVA into ROI.

64 LOVELY PROFESSIONAL UNIVERSITY