Page 89 - DMGT405_FINANCIAL%20MANAGEMENT

P. 89

Unit 5: Risk and Return Analysis

Notes

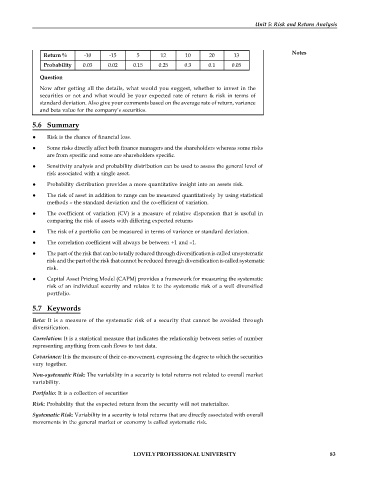

Return % -10 -15 5 12 10 20 13

Probability 0.03 0.02 0.15 0.25 0.3 0.1 0.05

Question

Now after getting all the details, what would you suggest, whether to invest in the

securities or not and what would be your expected rate of return & risk in terms of

standard deviation. Also give your comments based on the average rate of return, variance

and beta value for the company’s securities.

5.6 Summary

Risk is the chance of financial loss.

Some risks directly affect both finance managers and the shareholders whereas some risks

are from specific and some are shareholders specific.

Sensitivity analysis and probability distribution can be used to assess the general level of

risk associated with a single asset.

Probability distribution provides a more quantitative insight into an assets risk.

The risk of asset in addition to range can be measured quantitatively by using statistical

methods – the standard deviation and the co-efficient of variation.

The coefficient of variation (CV) is a measure of relative dispension that is useful in

comparing the risk of assets with differing expected returns

The risk of a portfolio can be measured in terms of variance or standard deviation.

The correlation coefficient will always be between +1 and –1.

The part of the risk that can be totally reduced through diversification is called unsystematic

risk and the part of the risk that cannot be reduced through diversification is called systematic

risk.

Capital Asset Pricing Model (CAPM) provides a framework for measuring the systematic

risk of an individual security and relates it to the systematic risk of a well diversified

portfolio.

5.7 Keywords

Beta: It is a measure of the systematic risk of a security that cannot be avoided through

diversification.

Correlation: It is a statistical measure that indicates the relationship between series of number

representing anything from cash flows to test data.

Covariance: It is the measure of their co-movement, expressing the degree to which the securities

vary together.

Non-systematic Risk: The variability in a security is total returns not related to overall market

variability.

Portfolio: It is a collection of securities

Risk: Probability that the expected return from the security will not materialize.

Systematic Risk: Variability in a security is total returns that are directly associated with overall

movements in the general market or economy is called systematic risk.

LOVELY PROFESSIONAL UNIVERSITY 83