Page 108 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 108

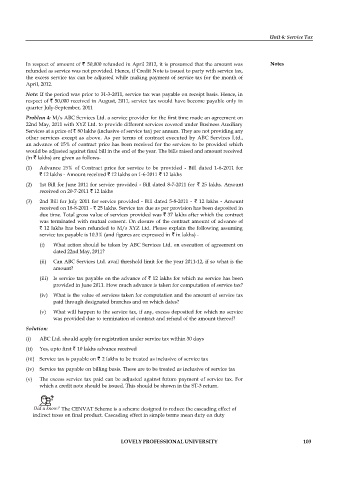

Unit 6: Service Tax

In respect of amount of 50,000 refunded in April 2012, it is presumed that the amount was Notes

refunded as service was not provided. Hence, if Credit Note is issued to party with service tax,

the excess service tax can be adjusted while making payment of service tax for the month of

April, 2012.

Note: If the period was prior to 31-3-2011, service tax was payable on receipt basis. Hence, in

respect of 50,000 received in August, 2011, service tax would have become payable only in

quarter July-September, 2011

Problem 4: M/s ABC Services Ltd. a service provider for the first time made an agreement on

22nd May, 2011 with XYZ Ltd. to provide different services covered under Business Auxiliary

Services at a price of 80 lakhs (inclusive of service tax) per annum. They are not providing any

other services except as above. As per terms of contract executed by ABC Services Ltd.,

an advance of 15% of contract price has been received for the services to be provided which

would be adjusted against final bill in the end of the year. The bills raised and amount received

(in lakhs) are given as follows-

(1) Advance 15% of Contract price for service to be provided - Bill dated 1-6-2011 for

12 lakhs - Amount received 12 lakhs on 1-6-2011 12 lakhs

(2) 1st Bill for June 2011 for service provided - Bill dated 8-7-2011 for 25 lakhs. Amount

received on 20-7-2011 12 lakhs

(3) 2nd Bill for July 2011 for service provided - Bill dated 5-8-2011 - 12 lakhs - Amount

received on 18-8-2011 - 25 lakhs. Service tax due as per provision has been deposited in

due time. Total gross value of services provided was 37 lakhs after which the contract

was terminated with mutual consent. On closure of the contract amount of advance of

12 lakhs has been refunded to M/s XYZ Ltd. Please explain the following assuming

service tax payable is 10.3% (and figures are expressed in in lakhs) -

(i) What action should be taken by ABC Services Ltd. on execution of agreement on

dated 22nd May, 2011?

(ii) Can ABC Services Ltd. avail threshold limit for the year 2011-12, if so what is the

amount?

(iii) Is service tax payable on the advance of 12 lakhs for which no service has been

provided in June 2011. How much advance is taken for computation of service tax?

(iv) What is the value of services taken for computation and the amount of service tax

paid through designated branches and on which dates?

(v) What will happen to the service tax, if any, excess deposited for which no service

was provided due to termination of contract and refund of the amount thereof?

Solution:

(i) ABC Ltd. should apply for registration under service tax within 30 days

(ii) Yes, upto first 10 lakhs advance received

(iii) Service tax is payable on 2 lakhs to be treated as inclusive of service tax

(iv) Service tax payable on billing basis. These are to be treated as inclusive of service tax

(v) The excess service tax paid can be adjusted against future payment of service tax. For

which a credit note should be issued. This should be shown in the ST-3 return.

Did u know? The CENVAT Scheme is a scheme designed to reduce the cascading effect of

indirect taxes on final product. Cascading effect in simple terms mean duty on duty

LOVELY PROFESSIONAL UNIVERSITY 103