Page 110 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 110

Unit 6: Service Tax

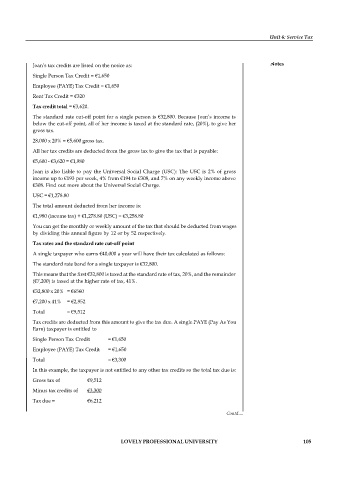

Joan’s tax credits are listed on the notice as: Notes

Single Person Tax Credit = €1,650

Employee (PAYE) Tax Credit = €1,650

Rent Tax Credit = €320

Tax credit total = €3,620.

The standard rate cut-off point for a single person is €32,800. Because Joan’s income is

below the cut-off point, all of her income is taxed at the standard rate, (20%), to give her

gross tax.

28,000 x 20% = €5,600 gross tax.

All her tax credits are deducted from the gross tax to give the tax that is payable:

€5,600 - €3,620 = €1,980

Joan is also liable to pay the Universal Social Charge (USC): The USC is 2% of gross

income up to €193 per week, 4% from €194 to €308, and 7% on any weekly income above

€308. Find out more about the Universal Social Charge.

USC = €1,278.80

The total amount deducted from her income is:

€1,980 (income tax) + €1,278.80 (USC) = €3,258.80

You can get the monthly or weekly amount of the tax that should be deducted from wages

by dividing this annual figure by 12 or by 52 respectively.

Tax rates and the standard rate cut-off point

A single taxpayer who earns €40,000 a year will have their tax calculated as follows:

The standard rate band for a single taxpayer is €32,800.

This means that the first €32,800 is taxed at the standard rate of tax, 20%, and the remainder

(€7,200) is taxed at the higher rate of tax, 41%.

€32,800 x 20% = €6560

€7,200 x 41% = €2,952

Total = €9,512

Tax credits are deducted from this amount to give the tax due. A single PAYE (Pay As You

Earn) taxpayer is entitled to

Single Person Tax Credit = €1,650

Employee (PAYE) Tax Credit = €1,650

Total = €3,300

In this example, the taxpayer is not entitled to any other tax credits so the total tax due is:

Gross tax of €9,512

Minus tax credits of €3,300

Tax due = €6,212

Contd....

LOVELY PROFESSIONAL UNIVERSITY 105