Page 116 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 116

Unit 7: Collection and Recovery of Service Tax and Assessment Procedure

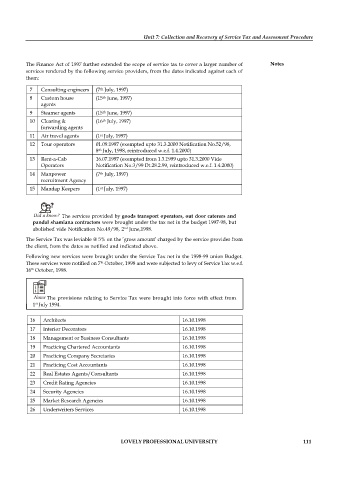

The Finance Act of 1997 further extended the scope of service tax to cover a larger number of Notes

services rendered by the following service providers, from the dates indicated against each of

them:

7 Consulting engineers (7 July, 1997)

th

8 Custom house (15 June, 1997)

th

agents

9 Steamer agents (15 June, 1997)

th

th

10 Clearing & (16 July, 1997)

forwarding agents

st

11 Air travel agents (1 July, 1997)

12 Tour operators 01.09.1997 (exempted upto 31.3.2000 Notification No.52/98,

8 July, 1998, reintroduced w.e.f. 1.4.2000)

th

13 Rent-a-Cab 16.07.1997 (exempted from 1.3.1999 upto 31.3.2000 Vide

Operators Notification No.3/99 Dt.28.2.99, reintroduced w.e.f. 1.4.2000)

14 Manpower (7 July, 1997)

th

recruitment Agency

15 Mandap Keepers (1 July, 1997)

st

Did u know? The services provided by goods transport operators, out door caterers and

pandal shamiana contractors were brought under the tax net in the budget 1997-98, but

nd

abolished vide Notification No.49/98, 2 June,1998.

The Service Tax was leviable @ 5% on the ’gross amount’ charged by the service provider from

the client, from the dates as notified and indicated above.

Following new services were brought under the Service Tax net in the 1998-99 union Budget.

These services were notified on 7 October, 1998 and were subjected to levy of Service Tax w.e.f.

th

th

16 October, 1998.

Notes The provisions relating to Service Tax were brought into force with effect from

st

1 July 1994.

16 Architects 16.10.1998

17 Interior Decorators 16.10.1998

18 Management or Business Consultants 16.10.1998

19 Practicing Chartered Accountants 16.10.1998

20 Practicing Company Secretaries 16.10.1998

21 Practicing Cost Accountants 16.10.1998

22 Real Estates Agents/Consultants 16.10.1998

23 Credit Rating Agencies 16.10.1998

24 Security Agencies 16.10.1998

25 Market Research Agencies 16.10.1998

26 Underwriters Services 16.10.1998

LOVELY PROFESSIONAL UNIVERSITY 111