Page 119 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 119

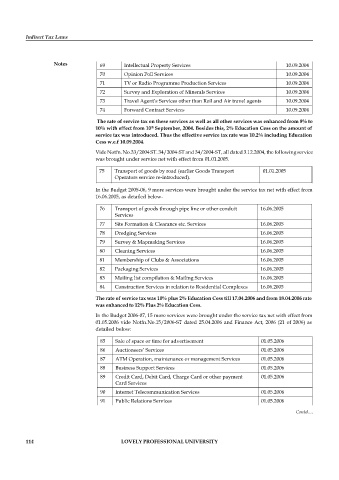

63 Out door Caterer’s service (re-introduced) 10.09.2004

64 Pandal or Shamiana service (re-introduced) 10.09.2004

65 Airport Services 10.09.2004

66 Transport of Goods by Air Services 10.09.2004

Indirect Tax Laws

67 Business Exhibition Services 10.09.2004

68 Construction Services in relation to commercial or Industrial 10.09.2004

Building

Notes 69 Intellectual Property Services 10.09.2004

70 Opinion Poll Services 10.09.2004

71 TV or Radio Programme Production Services 10.09.2004

72 Survey and Exploration of Minerals Services 10.09.2004

73 Travel Agent’s Services other than Rail and Air travel agents 10.09.2004

74 Forward Contract Services 10.09.2004

The rate of service tax on these services as well as all other services was enhanced from 8% to

th

10% with effect from 10 September, 2004. Besides this, 2% Education Cess on the amount of

service tax was introduced. Thus the effective service tax rate was 10.2% including Education

Cess w.e.f 10.09.2004.

Vide Notfn. No.33/2004 ST. 34/2004-ST and 34/2004-ST, all dated 3.12.2004, the following service

was brought under service net with effect from 01.01.2005.

75 Transport of goods by road (earlier Goods Transport 01.01.2005

Operators service re-introduced).

In the Budget 2005-06, 9 more services were brought under the service tax net with effect from

16.06.2005, as detailed below-

76 Transport of goods through pipe line or other conduit 16.06.2005

Services

77 Site Formation & Clearance etc. Services 16.06.2005

78 Dredging Services 16.06.2005

79 Survey & Mapmaking Services 16.06.2005

80 Cleaning Services 16.06.2005

81 Membership of Clubs & Associations 16.06.2005

82 Packaging Services 16.06.2005

83 Mailing list compilation & Mailing Services 16.06.2005

84 Construction Services in relation to Residential Complexes 16.06.2005

The rate of service tax was 10% plus 2% Education Cess till 17.04.2006 and from 18.04.2006 rate

was enhanced to 12% Plus 2% Education Cess.

In the Budget 2006-07, 15 more services were brought under the service tax net with effect from

01.05.2006 vide Notfn.No.15/2006-ST dated 25.04.2006 and Finance Act, 2006 (21 of 2006) as

detailed below:

85 Sale of space or time for advertisement 01.05.2006

86 Auctioneers’ Services 01.05.2006

87 ATM Operation, maintenance or management Services 01.05.2006

88 Business Support Services 01.05.2006

89 Credit Card, Debit Card, Charge Card or other payment 01.05.2006

Card Services

90 Internet Telecommunication Services 01.05.2006

91 Public Relations Services 01.05.2006

Contd....

114 LOVELY PROFESSIONAL UNIVERSITY