Page 238 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 238

Unit 14: Value Added Tax

Tax Amount Notes

The total Tax Amount calculated on Assessable value using the respective Tax percentage is the

Tax Amount.

Notes You can drill down the VAT Computation screen to view the VAT Classification

vouchers.

F1: Detailed: To view the VAT Computation Report in detail, click the button F1: Detailed or

press Alt + F1.

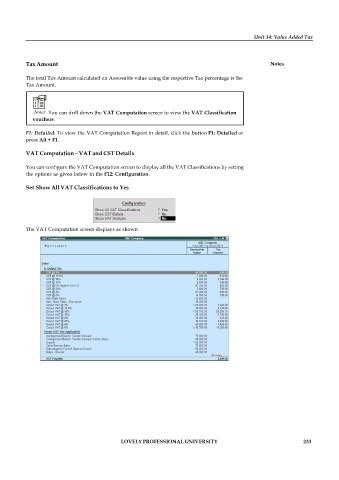

VAT Computation – VAT and CST Details

You can configure the VAT Computation screen to display all the VAT Classifications by setting

the options as given below in the F12: Configuration.

Set Show All VAT Classifications to Yes

The VAT Computation screen displays as shown:

LOVELY PROFESSIONAL UNIVERSITY 233