Page 240 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 240

Unit 14: Value Added Tax

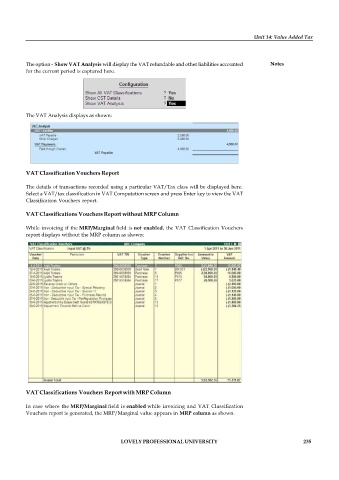

The option - Show VAT Analysis will display the VAT refundable and other liabilities accounted Notes

for the current period is captured here.

The VAT Analysis displays as shown:

VAT Classification Vouchers Report

The details of transactions recorded using a particular VAT/Tax class will be displayed here.

Select a VAT/tax classification in VAT Computation screen and press Enter key to view the VAT

Classification Vouchers report.

VAT Classifications Vouchers Report without MRP Column

While invoicing if the MRP/Marginal field is not enabled, the VAT Classification Vouchers

report displays without the MRP column as shown:

VAT Classifications Vouchers Report with MRP Column

In case where the MRP/Marginal field is enabled while invoicing and VAT Classification

Vouchers report is generated, the MRP/Marginal value appears in MRP column as shown.

LOVELY PROFESSIONAL UNIVERSITY 235