Page 94 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 94

Unit 6: Service Tax

6.3 Existing scheme for levy, assessment and collection of Notes

Service Tax in India

Service tax is levied on specified taxable services and the responsibility of payment of the tax is

cast on the service provider. System of self-assessment of Service Tax Returns by service tax

assessees has been introduced w.e.f. 01.04.2001. The jurisdictional Superintendent of Central

Excise is authorized to cross verify the correctness of self assessed returns. Tax returns are

expected to be filed half yearly.

Central Excise Officers are authorized to conduct surveys to bring the prospective service tax

assessees under the tax net. Directorate of Service Tax at Mumbai oversees the activities at the

field level for technical and policy level coordination.

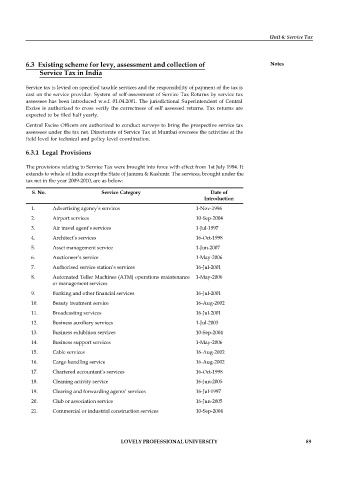

6.3.1 Legal Provisions

The provisions relating to Service Tax were brought into force with effect from 1st July 1994. It

extends to whole of India except the State of Jammu & Kashmir. The services, brought under the

tax net in the year 2009-2010, are as below:

S. No. Service Category Date of

Introduction

1. Advertising agency’s services 1-Nov-1996

2. Airport services 10-Sep-2004

3. Air travel agent’s services 1-Jul-1997

4. Architect’s services 16-Oct-1998

5. Asset management service 1-Jun-2007

6. Auctioneer’s service 1-May-2006

7. Authorised service station’s services 16-Jul-2001

8. Automated Teller Machines (ATM) operations maintenance 1-May-2006

or management services

9. Banking and other financial services 16-Jul-2001

10. Beauty treatment service 16-Aug-2002

11. Broadcasting services 16-Jul-2001

12. Business auxiliary services 1-Jul-2003

13. Business exhibition services 10-Sep-2004

14. Business support services 1-May-2006

15. Cable services 16-Aug-2002

16. Cargo handling service 16-Aug-2002

17. Chartered accountant’s services 16-Oct-1998

18. Cleaning activity service 16-Jun-2005

19. Clearing and forwarding agents’ services 16-Jul-1997

20. Club or association service 16-Jun-2005

21. Commercial or industrial construction services 10-Sep-2004

22. Commercial training or coaching service 1-Jul-2003

23. Commodity exchange service 16-May-2008

24. Company secretary’s services LOVELY PROFESSIONAL UNIVERSITY 89

16-Oct-1998

25. Computer network services (On-line information 16-Jul-2001

26. and database access or retrieval services)

27. Construction of complex service 16-Jun-2005

28. Consulting engineer’s services 7-Jul-1997

29. Convention services 16-Jul-2001

30. Cosmetic and plastic surgery service 1-Sept-2009

31. Cost accountant’s services 16-Oct-1998

32. Courier service 1-Nov-1996

33. Credit card, debit card, charge card or other payment card 1-May-2006

service

34. Credit rating agency’s services 16-Oct-1998