Page 95 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 95

Indirect Tax Laws

Notes

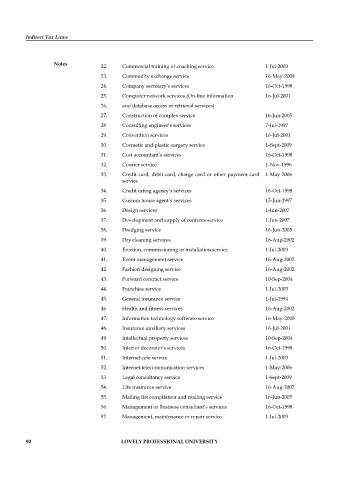

22. Commercial training or coaching service 1-Jul-2003

23. Commodity exchange service 16-May-2008

24. Company secretary’s services 16-Oct-1998

25. Computer network services (On-line information 16-Jul-2001

26. and database access or retrieval services)

27. Construction of complex service 16-Jun-2005

28. Consulting engineer’s services 7-Jul-1997

29. Convention services 16-Jul-2001

30. Cosmetic and plastic surgery service 1-Sept-2009

31. Cost accountant’s services 16-Oct-1998

32. Courier service 1-Nov-1996

33. Credit card, debit card, charge card or other payment card 1-May-2006

service

34. Credit rating agency’s services 16-Oct-1998

35. Custom house agent’s services 15-Jun-1997

36. Design services 1-Jun-2007

37. Development and supply of contents service 1-Jun-2007

38. Dredging service 16-Jun-2005

39. Dry cleaning services 16-Aug-2002

40. Erection, commissioning or installation service 1-Jul-2003

41. Event management service 16-Aug-2002

42. Fashion designing service 16-Aug-2002

43. Forward contract service 10-Sep-2004

44. Franchise service 1-Jul-2003

45. General insurance service 1-Jul-1994

46. Health and fitness services 16-Aug-2002

47. Information technology software service 16-May-2008

48. Insurance auxiliary services 16-Jul-2001

49. Intellectual property services 10-Sep-2004

50. Interior decorator’s services 16-Oct-1998

51. Internet cafe service 1-Jul-2003

52. Internet telecommunication services 1-May-2006

53. Legal consultancy service 1-Sept-2009

54. Life insurance service 16-Aug-2002

55. Mailing list compilation and mailing service 16-Jun-2005

56. Management or Business consultant’s services 16-Oct-1998

57. Management, maintenance or repair service 1-Jul-2003

58. Management of investment under ULIP service 16-May-2008

90 LOVELY PROFESSIONAL UNIVERSITY