Page 161 - DCOM309_INSURANCE_LAWS_AND_PRACTICES

P. 161

Insurance Laws and Practices

Notes

Among the private sector companies, SBI General recorded a growth of 82.23 per cent,

followed by Max Bupa at 68.97 per cent and L&T General at 51.97 per cent.

Big players like ICICI Lombard, Bajaj Allianz and HDFC Ergo General recorded a premium

growth of 19.02 per cent, 17.29 per cent and 18.27 per cent, respectively.

As regards the state-owned companies, New India Assurance reported an increase in

premium of 12.33 per cent, followed by Oriental Insurance at 11.75 per cent, National

Insurance at 9.73 per cent and United India at 7.07 per cent.

Source: http://articles.economictimes.indiatimes.com/2013-11-24/news/44412751_1_premium-

collection-21-private-sector-companies-sbi-general

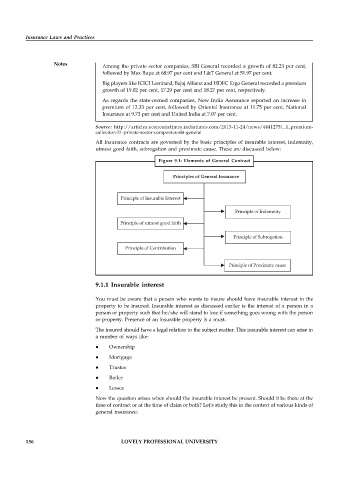

All Insurance contracts are governed by the basic principles of insurable interest, indemnity,

utmost good faith, subrogation and proximate cause. These are discussed below:

Figure 9.1: Elements of General Contract

Principles of General Insurance

Principle of Insurable Interest

Principle of Indemnity

Principle of utmost good faith

Principle of Subrogation

Principle of Contribution

Principle of Proximate cause

9.1.1 Insurable interest

You must be aware that a person who wants to insure should have insurable interest in the

property to be insured. Insurable interest as discussed earlier is the interest of a person in a

person or property such that he/she will stand to lose if something goes wrong with the person

or property. Presence of an insurable property is a must.

The insured should have a legal relation to the subject matter. This insurable interest can arise in

a number of ways like:

Ownership

Mortgage

Trustee

Bailer

Lessee

Now the question arises when should the insurable interest be present. Should it be there at the

time of contract or at the time of claim or both? Let’s study this in the context of various kinds of

general insurance:

156 LOVELY PROFESSIONAL UNIVERSITY