Page 164 - DCOM309_INSURANCE_LAWS_AND_PRACTICES

P. 164

Unit 9: Marine Insurance

geographical area in which it is used, the owner’s driver’s convictions for traffic Notes

offences etc., age, height and weight, physical disabilities, etc.

General: The fact that the previous insurers had rejected the proposal or charged

extra premium, or cancelled or refused to renew the policy, previous losses suffered

by the proposer.

If the insurance is placed through an agent, the agent has similar duty to disclose all material

facts known to him in the agents report.

9.1.4 Subrogation

Let’s discuss subrogation in this section. Subrogation is the right which an insurer gets, after he

has indemnified the loss, to step into the shoes of the insured and avail himself all the rights and

remedies which the insured may have in respect of the loss indemnified.

Did u know? Subrogation is the principle, which is applied to all contracts of indemnity. It

means that after indemnifying the loss, the insurer gets the right of taking all steps to

recover any money in compensation from the third party or by the sale of the asset against

which claim has been paid.

9.1.5 Contribution

You must remember that if a property has been insured with more than one insurer and the loss

occurs, the insured will get a proportionate part of the loss from each insurer. This principle of

contribution is in support to the principle of indemnity which states that insurance must make

good only the actual loss suffered by the insured. If a person insures his property with many

insurers, it does not mean that he can recover the claim from all the insurers. Insurance does not

allow an insured to make a profit out of the loss. All the insurers will contribute the insured’s

loss in proportion of the sum assured with each of them.

The insured may be able to recover the whole amount from one insurer, then as per the principle

of contribution, the insurer will attempt proportionate recoveries from other insurers concerned.

In order to avoid this inconvenience to the first insurer, fire policies and a majority of accident

policies contain a contribution condition, which says, whenever contribution applies, the insured

is obliged to raise claims against all the insurers, each of whom pays only his proportion of the

loss. This can be illustrated with an example.

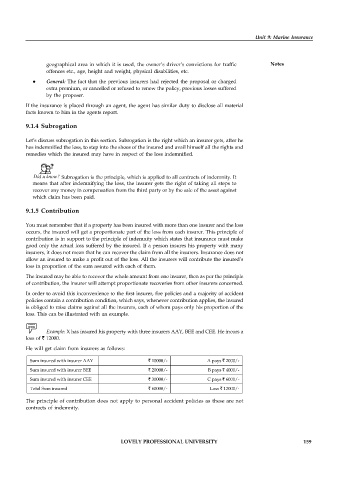

Example: X has insured his property with three insurers AAY, BEE and CEE. He incurs a

loss of ` 12000.

He will get claim from insurers as follows:

Sum insured with insurer AAY ` 10000/- A pays ` 2000/-

Sum insured with insurer BEE ` 20000/- B pays ` 4000/-

Sum insured with insurer CEE ` 30000/- C pays ` 6000/-

Total Sum insured ` 60000/- Loss ` 12000/-

The principle of contribution does not apply to personal accident policies as these are not

contracts of indemnity.

LOVELY PROFESSIONAL UNIVERSITY 159