Page 167 - DCOM309_INSURANCE_LAWS_AND_PRACTICES

P. 167

Insurance Laws and Practices

Notes

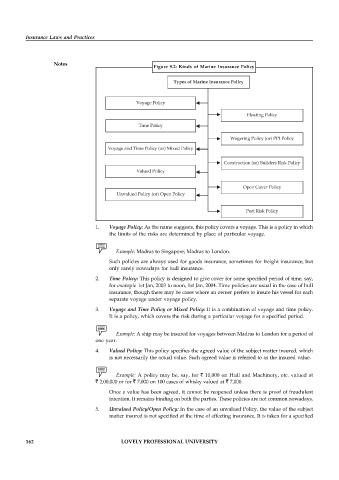

Figure 9.2: Kinds of Marine Insurance Policy

Types of Marine Insurance Policy

Voyage Policy

Floating Policy

Time Policy

Wagering Policy (or) PPI Policy

Voyage and Time Policy (or) Mixed Policy

Construction (or) Builders Risk Policy

Valued Policy

Open Cover Policy

Unvalued Policy (or) Open Policy

Port Risk Policy

1. Voyage Policy: As the name suggests, this policy covers a voyage. This is a policy in which

the limits of the risks are determined by place of particular voyage.

Example: Madras to Singapore; Madras to London.

Such policies are always used for goods insurance, sometimes for freight insurance, but

only rarely nowadays for hull insurance.

2. Time Policy: This policy is designed to give cover for some specified period of time, say,

for example 1st Jan, 2003 to noon, 1st Jan, 2004. Time policies are usual in the case of hull

insurance, though there may be cases where an owner prefers to insure his vessel for each

separate voyage under voyage policy.

3. Voyage and Time Policy or Mixed Policy: It is a combination of voyage and time policy.

It is a policy, which covers the risk during a particular voyage for a specified period.

Example: A ship may be insured for voyages between Madras to London for a period of

one year.

4. Valued Policy: This policy specifies the agreed value of the subject matter insured, which

is not necessarily the actual value. Such agreed value is referred to as the insured value.

Example: A policy may be, say, for ` 10,000 on Hull and Machinery, etc. valued at

` 2,00,000 or for ` 7,000 on 100 cases of whisky valued at ` 7,000.

Once a value has been agreed, it cannot be reopened unless there is proof of fraudulent

intention. It remains binding on both the parties. These policies are not common nowadays.

5. Unvalued Policy/Open Policy: In the case of an unvalued Policy, the value of the subject

matter insured is not specified at the time of effecting insurance. It is taken for a specified

162 LOVELY PROFESSIONAL UNIVERSITY