Page 29 - DCOM309_INSURANCE_LAWS_AND_PRACTICES

P. 29

Insurance Laws and Practices

Notes Self Assessment

Fill in the blanks:

5. A firm must be able to sell all it products at the ………………………….. price.

6. A heavy dependence upon loan capital relative to ……………………. capital increases the

risks for creditors and shareholders both.

7. Occurrence of some …………………………………… events may result in either gain or

loss, whereas others cause only loss.

8. Most people would agree that ……………………………………. arises out of some

malfunctioning of the economic system.

2.3 Need for Insurance

You need to know that the concept of insurance was sparked by the idea of pooling risk. People

with families and valuable property have always faced the possibility of loss; even the possibility

of such loss has caused individuals so much concern that they have ultimately refused to live

without having options for replacement of their loss. Thus, the practice of insuring property for

its replacement value has evolved. Even more importantly, the practice of replacing of the

economic value of a human life has also grown out of this thought process.

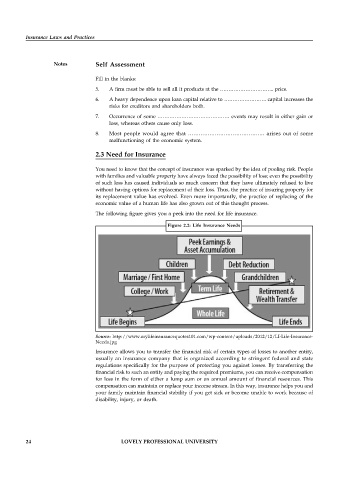

The following figure gives you a peek into the need for life insurance.

Figure 2.2: Life Insurance Needs

Source: http://www.mylifeinsurancequotes101.com/wp-content/uploads/2012/12/LI-Life-Insurance-

Needs.jpg

Insurance allows you to transfer the financial risk of certain types of losses to another entity,

usually an insurance company that is organized according to stringent federal and state

regulations specifically for the purpose of protecting you against losses. By transferring the

financial risk to such an entity and paying the required premiums, you can receive compensation

for loss in the form of either a lump sum or an annual amount of financial resources. This

compensation can maintain or replace your income stream. In this way, insurance helps you and

your family maintain financial stability if you get sick or become unable to work because of

disability, injury, or death.

24 LOVELY PROFESSIONAL UNIVERSITY