Page 34 - DCOM309_INSURANCE_LAWS_AND_PRACTICES

P. 34

Unit 2: Risk and Insurance

Advantageous things will be or are more likely to be achieved. Notes

An important part of determining the right level of insurance that you should have is

understanding risk. Risk, in terms of insurance, is uncertainty concerning the occurrence of a

loss.

There is risk in all areas of your life: there are risks involved in your lifestyle, your career, your

environment, and so on. You can manage risk in four ways: you can avoid risk, reduce risk,

assume risk, or transfer risk as shown in the figure below:

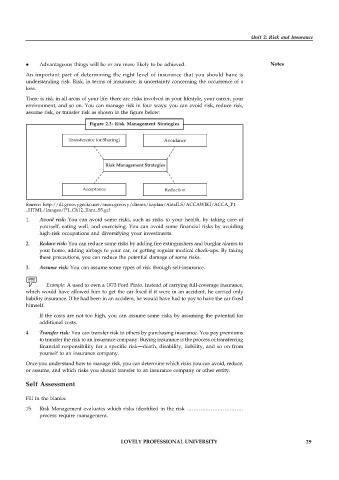

Figure 2.3: Risk Management Strategies

Transference (or Sharing) Avoidance

Risk Management Strategies

Acceptance Reduction

Source: http://dl.groovygecko.net/anon.groovy/clients/kaplan/AlexILS/ACCAWIKI/ACCA_P1

_HTML/Images/P1_Ch12_Tara_S5.gif

1. Avoid risk: You can avoid some risks, such as risks to your health, by taking care of

yourself, eating well, and exercising. You can avoid some financial risks by avoiding

high-risk occupations and diversifying your investments.

2. Reduce risk: You can reduce some risks by adding fire extinguishers and burglar alarms to

your home, adding airbags to your car, or getting regular medical check-ups. By taking

these precautions, you can reduce the potential damage of some risks.

3. Assume risk: You can assume some types of risk through self-insurance.

Example: A used to own a 1973 Ford Pinto. Instead of carrying full-coverage insurance,

which would have allowed him to get the car fixed if it were in an accident, he carried only

liability insurance. If he had been in an accident, he would have had to pay to have the car fixed

himself.

If the costs are not too high, you can assume some risks by assuming the potential for

additional costs.

4. Transfer risk: You can transfer risk to others by purchasing insurance. You pay premiums

to transfer the risk to an insurance company. Buying insurance is the process of transferring

financial responsibility for a specific risk—death, disability, liability, and so on from

yourself to an insurance company.

Once you understand how to manage risk, you can determine which risks you can avoid, reduce,

or assume, and which risks you should transfer to an insurance company or other entity.

Self Assessment

Fill in the blanks:

15. Risk Management evaluates which risks identified in the risk ……………………………

process require management.

LOVELY PROFESSIONAL UNIVERSITY 29