Page 56 - DCOM309_INSURANCE_LAWS_AND_PRACTICES

P. 56

Unit 4: Contract of Insurance

Several options like different types of accident benefits, coverage for major illnesses, payment Notes

in instalments for specific needs like children’s education and last survivor benefits are also

available.

Notes The major goal of insurance business is earning the maximum income out of the life

fund and matching the assets with liabilities.

The surplus as stated above is distributed among the policyholders in form of bonus or in case

of some policies may be offered as a reduction to the premium payable.

Group Insurance: Group insurance is nothing but insuring a group of individuals together. This

may be done due to their working in specific group, e.g., being partners, being employees of

same organization or being members of a particular organization formed for a specific purpose.

These products are similar to individual policies but are managed differently.

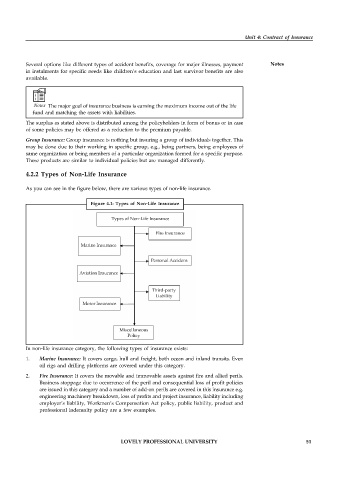

4.2.2 Types of Non-Life Insurance

As you can see in the figure below, there are various types of non-life insurance.

Figure 4.1: Types of Non-Life Insurance

Types of Non-Life Insurance

Fire Insurance

Marine Insurance

Personal Accident

Aviation Insurance

Third-party

Liability

Motor Insurance

Miscellaneous

Policy

In non-life insurance category, the following types of insurance exists:

1. Marine Insurance: It covers cargo, hull and freight, both ocean and inland transits. Even

oil rigs and drilling platforms are covered under this category.

2. Fire Insurance: It covers the movable and immovable assets against fire and allied perils.

Business stoppage due to occurrence of the peril and consequential loss of profit policies

are issued in this category and a number of add-on perils are covered in this insurance e.g.

engineering machinery breakdown, loss of profits and project insurance, liability including

employer’s liability, Workmen’s Compensation Act policy, public liability, product and

professional indemnity policy are a few examples.

LOVELY PROFESSIONAL UNIVERSITY 51