Page 61 - DCOM309_INSURANCE_LAWS_AND_PRACTICES

P. 61

Insurance Laws and Practices

Notes

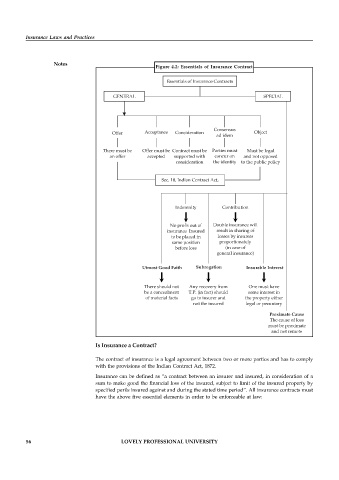

Figure 4.2: Essentials of Insurance Contract

Essentials of Insurance Contracts

GENERAL SPECIAL

Offer Acceptance Consideration Consensus Object

ad idem

There must be Offer must be Contract must be Parties must Must be legal

an offer accepted supported with concur on and not opposed

consideration the identity to the public policy

Sec. 10, Indian Contract Act,

Indemnity Contribution

No profit out of Double insurance will

insurance Insured result in sharing of

to be placed in losses by insurers

same position proportionately

before loss (in case of

general insurance)

Utmost Good Faith Subrogation Insurable Interest

There should not Any recovery from One must have

be a concealment T.P. (in fact) should some interest in

of material facts go to insurer and the property either

not the insured legal or pecuniary

Proximate Cause

The cause of loss

must be proximate

and not remote

Is Insurance a Contract?

The contract of insurance is a legal agreement between two or more parties and has to comply

with the provisions of the Indian Contract Act, 1872.

Insurance can be defined as “a contract between an insurer and insured, in consideration of a

sum to make good the financial loss of the insured, subject to limit of the insured property by

specified perils insured against and during the stated time period”. All insurance contracts must

have the above five essential elements in order to be enforceable at law:

56 LOVELY PROFESSIONAL UNIVERSITY