Page 117 - DCOM302_MANAGEMENT_ACCOUNTING

P. 117

Management Accounting

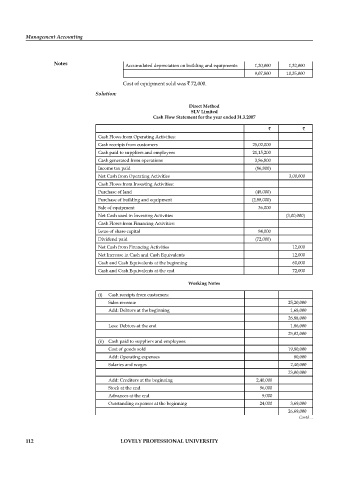

Notes Accumulated depreciation on building and equipments 1,20,000 1,32,000

9,07,800 10,35,000

Cost of equipment sold was ` 72,000.

Solution:

Direct Method

SLV Limited

Cash Flow Statement for the year ended 31.3.2007

` `

Cash Flows from Operating Activities:

Cash receipts from customers 25,02,000

Cash paid to suppliers and employees 21,15,200

Cash generated from operations 3,86,800

Income tax paid (86,800)

Net Cash from Operating Activities 3,00,000

Cash Flows from Investing Activities:

Purchase of land (48,000)

Purchase of building and equipment (2,88,000)

Sale of equipment 36,000

Net Cash used in Investing Activities (3,00,000)

Cash Flows from Financing Activities:

Issue of share capital 84,000

Dividend paid (72,000)

Net Cash from Financing Activities 12,000

Net Increase in Cash and Cash Equivalents 12,000

Cash and Cash Equivalents at the beginning 60,000

Cash and Cash Equivalents at the end 72,000

Working Notes

(i) Cash receipts from customers:

Sales revenue 25,20,000

Add: Debtors at the beginning 1,68,000

26,88,000

Less: Debtors at the end 1,86,000

25,02,000

(ii) Cash paid to suppliers and employees:

Cost of goods sold 19,80,000

Add: Operating expenses 80,000

Salaries and wages 2,40,000

23,00,000

Add: Creditors at the beginning 2,40,000

Stock at the end 96,000

Advances at the end 9,000

Outstanding expenses at the beginning 24,000 3,69,000

26,69,000

Contd…

112 LOVELY PROFESSIONAL UNIVERSITY