Page 119 - DCOM302_MANAGEMENT_ACCOUNTING

P. 119

Management Accounting

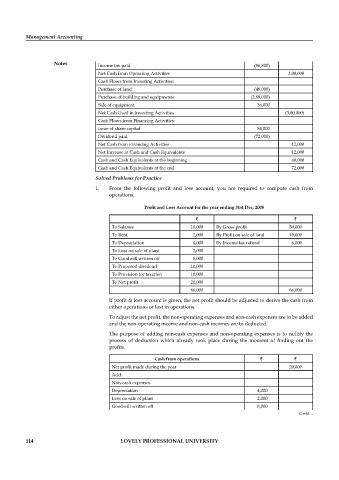

Notes Income tax paid (86,800)

Net Cash from Operating Activities 3,00,000

Cash Flows from Investing Activities:

Purchase of land (48,000)

Purchase of building and equipments (2,88,000)

Sale of equipment 36,000

Net Cash Used in Investing Activities (3,00,000)

Cash Flows from Financing Activities:

Issue of share capital 84,000

Dividend paid (72,000)

Net Cash from Financing Activities 12,000

Net Increase in Cash and Cash Equivalents 12,000

Cash and Cash Equivalents at the beginning 60,000

Cash and Cash Equivalents at the end 72,000

Solved Problems for Practice

1. From the following profit and loss account, you are required to compute cash from

operations.

Profit and Loss Account for the year ending 31st Dec, 2008

` `

To Salaries 10,000 By Gross profi t 50,000

To Rent 2,000 By Profit on sale of land 10,000

To Depreciation 4,000 By Income tax refund 6,000

To Loss on sale of plant 2,000

To Goodwill written off 8,000

To Proposed dividend 10,000

To Provision for taxation 10,000

To Net profi t 20,000

66,000 66,000

If profit & loss account is given, the net profit should be adjusted to derive the cash from

either operations or lost in operations.

To adjust the net profit, the non-operating expenses and non-cash expenses are to be added

and the non-operating income and non-cash incomes are to deducted.

The purpose of adding non-cash expenses and non-operating expenses is to nullify the

process of deduction which already took place during the moment of finding out the

profi ts.

Cash from operations ` `

Net profit made during the year 20,000

Add:

Non-cash expenses

Depreciation 4,000

Loss on sale of plant 2,000

Goodwill written off 8,000

Contd…

114 LOVELY PROFESSIONAL UNIVERSITY