Page 123 - DCOM302_MANAGEMENT_ACCOUNTING

P. 123

Management Accounting

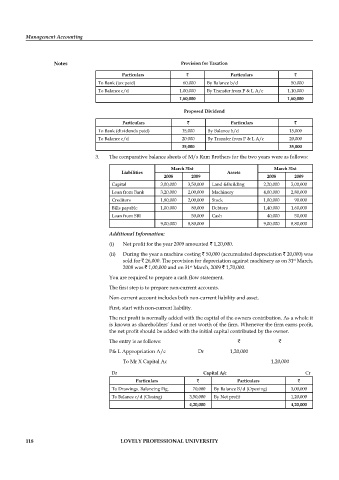

Notes Provision for Taxation

Particulars ` Particulars `

To Bank (tax paid) 60,000 By Balance b/d 50,000

To Balance c/d 1.00,000 By Transfer from P & L A/c 1,10,000

1,60,000 1,60,000

Proposed Dividend

Particulars ` Particulars `

To Bank (dividends paid) 15,000 By Balance b/d 15,000

To Balance c/d 20.000 By Transfer from P & L A/c 20,000

35,000 35,000

3. The comparative balance sheets of M/s Ram Brothers for the two years were as follows:

March 31st March 31st

Liabilities Assets

2008 2009 2008 2009

Capital 3,00,000 3,50,000 Land &Building 2,20,000 3,00,000

Loan from Bank 3,20,000 2,00,000 Machinery 4,00,000 2,80,000

Creditors 1,80,000 2,00,000 Stock 1,00,000 90.000

Bills payable 1,00,000 80,000 Debtors 1,40,000 1,60,000

Loan from SBI 50,000 Cash 40,000 50,000

9,00,000 8,80,000 9,00,000 8,80,000

Additional Information:

(i) Net profit for the year 2009 amounted ` 1,20,000.

(ii) During the year a machine costing ` 50,000 (accumulated depreciation ` 20,000) was

sold for ` 26,000. The provision for depreciation against machinery as on 31 March,

st

st

2008 was ` 1,00,000 and on 31 March, 2009 ` 1,70,000.

You are required to prepare a cash fl ow statement.

The first step is to prepare non-current accounts.

Non-current account includes both non-current liability and asset.

First, start with non-current liability.

The net profit is normally added with the capital of the owners contribution. As a whole it

is known as shareholders’ fund or net worth of the fi rm. Whenever the fi rm earns profi t,

the net profit should be added with the initial capital contributed by the owner.

The entry is as follows: ` `

P& L Appropriation A/c Dr 1,20,000

To Mr X Capital Ac 1,20,000

Dr Capital A/c Cr

Particulars ` Particulars `

To Drawings. Balancing Fig. 70,000 By Balance B/d (Opening) 3,00,000

To Balance c/d (Closing) 3,50,000 By Net profi t 1,20,000

4,20,000 4,20,000

118 LOVELY PROFESSIONAL UNIVERSITY