Page 15 - DCOM302_MANAGEMENT_ACCOUNTING

P. 15

Management Accounting

Notes 2.1 Types of Financial Statements

There are four different types of financial statements. The different types of fi nancial statements

indicate the different activities occurring in a particular business house.

1. Income Statement

2. Retained Earnings Statement

3. Balance Sheet

4. Statement of Cash Flows

5. Fund Flow Statement

Let us understand each of them one by one.

1. Income Statement: Income statement, also called profit and loss statement (P&L) and

Statement of Operations, is a company’s financial statement that indicates how the revenue

(money received from the sale of products and services before expenses are taken out, also

known as the “top line”) is transformed into the net income (the result after all revenues

and expenses have been accounted for, also known as the “bottom line”). The purpose of

the income statement is to show managers and investors whether the company made or

lost money during the period being reported. The important thing to remember about an

income statement is that it represents a period of time.

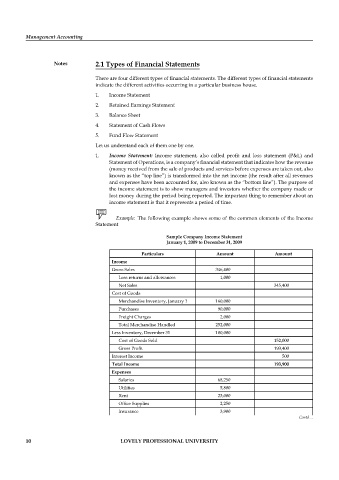

Example: The following example shows some of the common elements of the Income

Statement

Sample Company Income Statement

January 1, 2009 to December 31, 2009

Particulars Amount Amount

Income

Gross Sales 346,400

Less returns and allowances 1,000

Net Sales 345,400

Cost of Goods

Merchandise Inventory, January 1 160,000

Purchases 90,000

Freight Charges 2,000

Total Merchandise Handled 252,000

Less Inventory, December 31 100,000

Cost of Goods Sold 152,000

Gross Profi t 193,400

Interest Income 500

Total Income 193,900

Expenses

Salaries 68,250

Utilities 5,800

Rent 23,000

Offi ce Supplies 2,250

Insurance 3,900

Contd…

10 LOVELY PROFESSIONAL UNIVERSITY