Page 250 - DCOM302_MANAGEMENT_ACCOUNTING

P. 250

Unit 12: Decisions Involving Alternative Choices

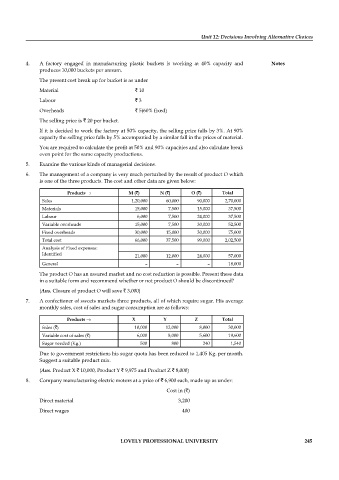

4. A factory engaged in manufacturing plastic buckets is working at 40% capacity and Notes

produces 10,000 buckets per annum.

The present cost break up for bucket is as under

Material ` 10

Labour ` 3

Overheads ` 5(60% fi xed)

The selling price is ` 20 per bucket.

If it is decided to work the factory at 50% capacity, the selling price falls by 3%. At 90%

capacity the selling price falls by 5% accompanied by a similar fall in the prices of material.

You are required to calculate the profit at 50% and 90% capacities and also calculate break

even point for the same capacity productions.

5. Examine the various kinds of managerial decisions.

6. The management of a company is very much perturbed by the result of product O which

is one of the three products. The cost and other data are given below:

Products → M (`) N (`) O (`) Total

Sales 1,20,000 60,000 90,000 2,70,000

Materials 15,000 7,500 15,000 37,500

Labour 6,000 7,500 24,000 37,500

Variable overheads 15,000 7,500 30,000 52,500

Fixed overheads 30,000 15,000 30,000 75,000

Total cost 66,000 37,500 99,000 2,02,500

Analysis of Fixed expenses:

Identifi ed 21,000 12,000 24,000 57,000

General – – – 18,000

The product O has an assured market and no cost reduction is possible. Present these data

in a suitable form and recommend whether or not product O should be discontinued?

(Ans. Closure of product O will save ` 3,000)

7. A confectioner of sweets markets three products, all of which require sugar. His average

monthly sales, cost of sales and sugar consumption are as follows:

Products → X Y Z Total

Sales (`) 10,000 12,000 8,000 30,000

Variable cost of sales (`) 6,000 8,000 5,600 19,600

Sugar needed (Kg.) 500 800 240 1,540

Due to government restrictions his sugar quota has been reduced to 1,405 Kg. per month.

Suggest a suitable product mix.

(Ans. Product X ` 10,000, Product Y ` 9,975 and Product Z ` 8,000)

8. Company manufacturing electric motors at a price of ` 6,900 each, made up as under:

Cost in (`)

Direct material 3,200

Direct wages 400

LOVELY PROFESSIONAL UNIVERSITY 245