Page 92 - DCOM302_MANAGEMENT_ACCOUNTING

P. 92

Unit 5: Fund Flow Statement

Notes

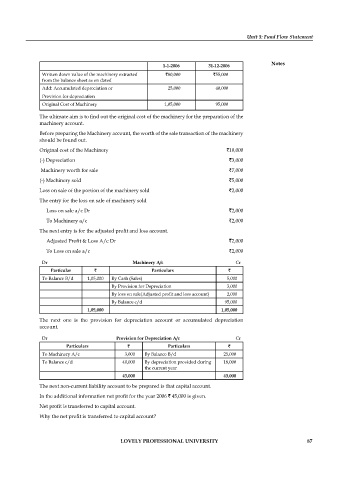

1-1-2006 31-12-2006

Written down value of the machinery extracted `80,000 `55,000

from the balance sheet as on dated

Add: Accumulated depreciation or 25,000 40,000

Provision for depreciation

Original Cost of Machinery 1,05,000 95,000

The ultimate aim is to find out the original cost of the machinery for the preparation of the

machinery account.

Before preparing the Machinery account, the worth of the sale transaction of the machinery

should be found out.

Original cost of the Machinery `10,000

(-) Depreciation `3,000

Machinery worth for sale `7,000

(-) Machinery sold `5,000

Loss on sale of the portion of the machinery sold `2,000

The entry for the loss on sale of machinery sold

Loss on sale a/c Dr `2,000

To Machinery a/c `2,000

The next entry is for the adjusted profit and loss account.

Adjusted Profit & Loss A/c Dr `2,000

To Loss on sale a/c `2,000

Dr Machinery A/c Cr

Particular ` Particulars `

To Balance B/d 1,05,000 By Cash (Sales) 5,000

By Provision for Depreciation 3,000

By loss on sale(Adjusted profit and loss account) 2,000

By Balance c/d 95,000

1,05,000 1,05,000

The next one is the provision for depreciation account or accumulated depreciation

account.

Dr Provision for Depreciation A/c Cr

Particulars ` Particulars `

To Machinery A/c 3,000 By Balance B/d 25,000

To Balance c/d 40,000 By depreciation provided during 18,000

the current year

43,000 43,000

The next non-current liability account to be prepared is that capital account.

In the additional information net profit for the year 2006 ` 45,000 is given.

Net profit is transferred to capital account.

Why the net profit is transferred to capital account?

LOVELY PROFESSIONAL UNIVERSITY 87