Page 96 - DCOM302_MANAGEMENT_ACCOUNTING

P. 96

Unit 5: Fund Flow Statement

During the purchase, what happens in the fi rm? Notes

The cash resources are going out of the firm and plant is coming into the business

enterprise.

Debit what comes in - Plant

Credit what goes out - Cash

Plant A/c `3,000

To Cash A/c `3,000

The next non-current asset account is Investment account.

The opening balance is less than that of the closing balance; which means that the fi rm has

made a purchase of investments worth of `1,000. The following is the journal entry:

Investments A/c Dr `1,000

To cash A/c `1,000

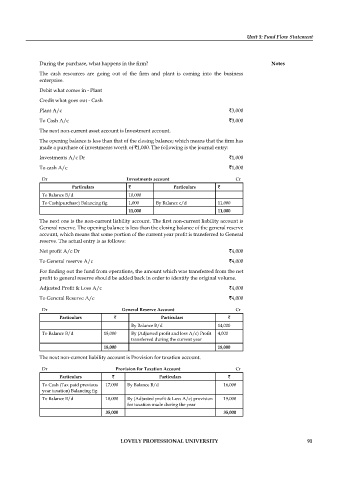

Dr Investments account Cr

Particulars ` Particulars `

To Balance B/d 10,000

To Cash(purchase) Balancing fig 1,000 By Balance c/d 11,000

11,000 11,000

The next one is the non-current liability account. The fi rst non-current liability account is

General reserve. The opening balance is less than the closing balance of the general reserve

account, which means that some portion of the current year profit is transferred to General

reserve. The actual entry is as follows:

Net profit A/c Dr `4,000

To General reserve A/c `4,000

For finding out the fund from operations, the amount which was transferred from the net

profit to general reserve should be added back in order to identify the original volume.

Adjusted Profit & Loss A/c `4,000

To General Reserve A/c `4,000

Dr General Reserve Account Cr

Particulars ` Particulars `

By Balance B/d 14,000

To Balance B/d 18,000 By (Adjusted profit and loss A/c) Profi t 4,000

transferred during the current year

18,000 18,000

The next non-current liability account is Provision for taxation account.

Dr Provision for Taxation Account Cr

Particulars ` Particulars `

To Cash (Tax paid previous 17,000 By Balance B/d 16,000

year taxation) Balancing fi g.

To Balance B/d 18,000 By (Adjusted profit & Loss A/c) provision 19,000

for taxation made during the year

35,000 35,000

LOVELY PROFESSIONAL UNIVERSITY 91