Page 327 - DCOM404_CORPORATE_LEGAL_FRAMEWORK

P. 327

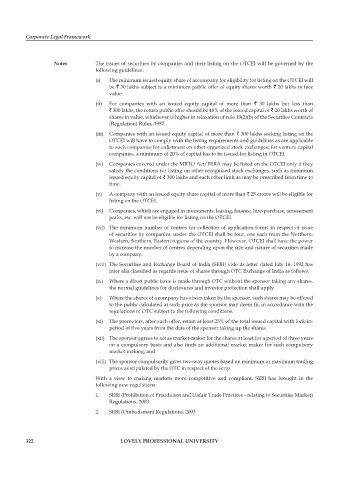

Corporate Legal Framework

Notes The issues of securities by companies and their listing on the OTCEI will be governed by the

following guidelines:

(i) The minimum issued equity share of accompany for eligibility for listing on the OTCEI will

be ` 30 lakhs subject to a minimum public offer of equity shares worth ` 20 lakhs in face

value.

(ii) For companies with an issued equity capital of more than ` 30 lakhs but less than

` 300 lakhs, the return public offer should be 40% of the issued capital or ` 20 lakhs worth of

shares in value, whichever is higher in relaxation of rule 19(2)(b) of the Securities Contracts

(Regulation) Rules, 1957.

(iii) Companies with an issued equity capital of more than ` 300 lakhs seeking listing on the

OTCEI will have to comply with the listing requirements and guidelines as are applicable

to such companies for enlistment on other organized stock exchanges; for venture capital

companies, a minimum of 20% of capital has to be issued for listing in OTCEI.

(iv) Companies covered under the MRTO Act/FERA may be listed on the OTCEI only if they

satisfy the conditions for listing on other recognized stock exchanges, such as minimum

issued equity capital of ` 300 lakhs and such other limit as may be prescribed from time to

time.

(v) A company with an issued equity share capital of more than ` 25 crores will be eligible for

listing on the OTCEI.

(vi) Companies, which are engaged in investments, leasing, finance, hire-purchase, amusement

parks, etc. will not be eligible for listing on the OTCEI.

(vii) The minimum number of centres for collection of application forms in respect of issue

of securities by companies, under the OTCEI shall be four, one each from the Northern,

Western, Southern, Eastern regions of the country. However, OTCEI shall have the power

to increase the number of centres depending upon the size and nature of securities made

by a company.

(viii) The Securities and Exchange Board of India (SEBI) vide its letter dated July 16, 1992 has

inter alia classified as regards issue of shares through OTC Exchange of India as follows.

(ix) Where a direct public issue is made through OTC without the sponsor taking any shares,

the normal guidelines for disclosures and investor protection shall apply.

(x) Where the shares of a company have been taken by the sponsor, such shares may be offered

to the public calculated at such price as the sponsor may deem fit, in accordance with the

regulations of OTC subject to the following conditions.

(xi) The promoters, after such offer, retain at least 25% of the total issued capital with lock-in-

period of five years from the date of the sponsor taking up the shares.

(xii) The sponsor agrees to act as market-maker for the shares at least for a period of three years

on a compulsory basis and also finds an additional market maker for such compulsory

market making, and

(xiii) The sponsor compulsorily gives two-way quotes based on minimum or maximum trading

prices as stipulated by the OTC in respect of the scrip.

With a view to making markets more competitive and compliant, SEBI has brought in the

following new regulations:

1. SEBI (Prohibition of Fraudulent and Unfair Trade Practices - relating to Securities Market)

Regulations, 2003

2. SEBI (Ombudsman) Regulations, 2003

322 LOVELY PROFESSIONAL UNIVERSITY