Page 283 - DMGT405_FINANCIAL%20MANAGEMENT

P. 283

Unit 13: Management of Cash

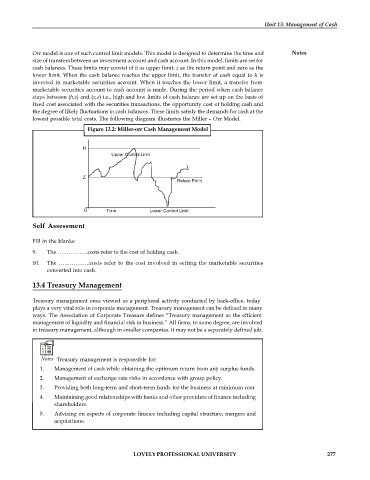

Orr model is one of such control limit models. This model is designed to determine the time and Notes

size of transfers between an investment account and cash account. In this model, limits are set for

cash balances. These limits may consist of h as upper limit, z as the return point and zero as the

lower limit. When the cash balance reaches the upper limit, the transfer of cash equal to h is

invested in marketable securities account. When it touches the lower limit, a transfer from

marketable securities account to cash account is made. During the period when cash balance

stays between (h,z) and (z,o) i.e., high and low limits of cash balance are set up on the basis of

fixed cost associated with the securities transactions, the opportunity cost of holding cash and

the degree of likely fluctuations in cash balances. These limits satisfy the demands for cash at the

lowest possible total costs. The following diagram illustrates the Miller – Orr Model.

Figure 13.2: Miller-orr Cash Management Model

H

Upper Control Limit

Z

Return Point

O Time Lower Control Limit

Self Assessment

Fill in the blanks:

9. The ……………..costs refer to the cost of holding cash.

10. The ……………..costs refer to the cost involved in setting the marketable securities

converted into cash.

13.4 Treasury Management

Treasury management once viewed as a peripheral activity conducted by back-office, today

plays a very vital role in corporate management. Treasury management can be defined in many

ways. The Association of Corporate Treasure defines “Treasury management as the efficient

management of liquidity and financial risk in business.” All firms, to some degree, are involved

in treasury management, although in smaller companies, it may not be a separately defined job.

Notes Treasury management is responsible for:

1. Management of cash while obtaining the optimum return from any surplus funds.

2. Management of exchange rate risks in accordance with group policy.

3. Providing both long-term and short-term funds for the business at minimum cost.

4. Maintaining good relationships with banks and other providers of finance including

shareholders.

5. Advising on aspects of corporate finance including capital structure, mergers and

acquisitions.

LOVELY PROFESSIONAL UNIVERSITY 277