Page 63 - DCOM409_CONTEMPORARY_ACCOUNTING

P. 63

Contemporary Accounting

Notes

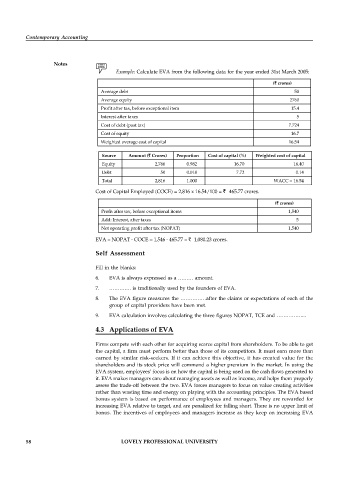

Example: Calculate EVA from the following data for the year ended 31st March 2005:

(` crores)

Average debt 50

Average equity 2760

Profit after tax, before exceptional item 15.4

Interest after taxes 5

Cost of debt (post tax) 7.724

Cost of equity 16.7

Weighted average cost of capital 16.54

Source Amount (` Crores) Proportion Cost of capital (%) Weighted cost of capital

Equity 2,766 0.982 16.70 16.40

Debt 50 0.018 7.72 0.14

Total 2,816 1.000 WACC = 16.54

Cost of Capital Employed (COCE) = 2,816 x 16.54/100 = ` 465.77 crores.

(` crores)

Profit after tax, before exceptional items 1,540

Add: Interest, after taxes 5

Net operating profit after tax (NOPAT) 1,540

EVA = NOPAT - COCE = 1,546 - 465.77 = ` 1,080.23 crores.

Self Assessment

Fill in the blanks:

6. EVA is always expressed as a ……… amount.

7. …………. is traditionally used by the founders of EVA.

8. The EVA figure measures the ……………after the claims or expectations of each of the

group of capital providers have been met.

9. EVA calculation involves calculating the three figures NOPAT, TCE and ……………...

4.3 Applications of EVA

Firms compete with each other for acquiring scarce capital from shareholders. To be able to get

the capital, a firm must perform better than those of its competitors. It must earn more than

earned by similar risk-seekers. If it can achieve this objective, it has created value for the

shareholders and its stock price will command a higher premium in the market. In using the

EVA system, employees’ focus is on how the capital is being used on the cash flows generated to

it. EVA makes managers care about managing assets as well as income, and helps them properly

assess the trade-off between the two. EVA forces managers to focus on value creating activities

rather than wasting time and energy on playing with the accounting principles. The EVA based

bonus system is based on performance of employees and managers. They are rewarded for

increasing EVA relative to target, and are penalized for falling short. There is no upper limit of

bonus. The incentives of employees and managers increase as they keep on increasing EVA

58 LOVELY PROFESSIONAL UNIVERSITY