Page 162 - DCOM304_INDIAN_FINANCIAL_SYSTEM

P. 162

Unit 8: Financial Institutions

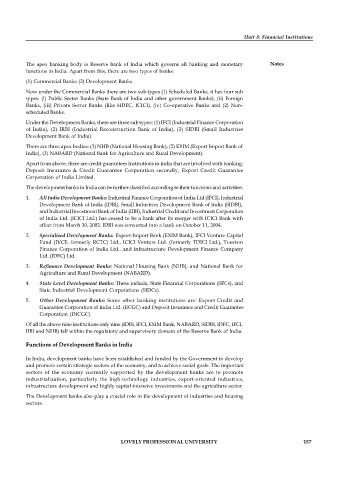

The apex banking body is Reserve bank of India which governs all banking and monetary Notes

functions in India. Apart from this, there are two types of banks:

(1) Commercial Banks (2) Development Banks

Now under the Commercial Banks there are two sub-types (1) Scheduled Banks, it has four sub

types: (i) Public Sector Banks (State Bank of India and other government Banks), (ii) Foreign

Banks, (iii) Private Sector Banks (like HDFC, ICICI), (iv) Co-operative Banks and (2) Non-

scheduled Banks.

Under the Development Banks, there are three sub types: (1) IFCI (Industrial Finance Corporation

of India), (2) IRBI (Industrial Reconstruction Bank of India), (3) SIDBI (Small Industries

Development Bank of India).

There are three apex bodies: (1) NHB (National Housing Bank), (2) EXIM (Export Import Bank of

India), (3) NABARD (National Bank for Agriculture and Rural Development).

Apart from above, there are credit guarantees Institutions in India that are involved with banking:

Deposit Insurance & Credit Guarantee Corporation secondly, Export Credit Guarantee

Corporation of India Limited.

The development banks in India can be further classified according to their functions and activities:

1. All India Development Banks: Industrial Finance Corporation of India Ltd (IFCI), Industrial

Development Bank of India (IDBI), Small Industries Development Bank of India (SIDBI),

and Industrial Investment Bank of India (IIBI), Industrial Credit and Investment Corporation

of India Ltd. (ICICI Ltd.) has ceased to be a bank after its merger with ICICI Bank with

effect from March 30, 2002. IDBI was converted into a bank on October 11, 2004.

2. Specialised Development Banks: Export-Import Bank (EXIM Bank), IFCI Venture Capital

Fund (IVCF, formerly RCTC) Ltd., ICICI Venture Ltd. (formerly TDICI Ltd.), Tourism

Finance Corporation of India Ltd., and Infrastructure Development Finance Company

Ltd. (IDFC) Ltd.

3. Refinance Development Banks: National Housing Bank (NHB), and National Bank for

Agriculture and Rural Development (NABARD).

4. State Level Development Banks: These include, State Financial Corporations (SFCs), and

State Industrial Development Corporations (SIDCs).

5. Other Development Banks: Some other banking institutions are: Export Credit and

Guarantee Corporation of India Ltd. (ECGC) and Deposit Insurance and Credit Guarantee

Corporation (DICGC).

Of all the above nine institutions only nine (IDBI, IFCI, EXIM Bank, NABARD, SIDBI, IDFC, IFCI,

IIBI and NHB) fall within the regulatory and supervisory domain of the Reserve Bank of India.

Functions of Development Banks in India

In India, development banks have been established and funded by the Government to develop

and promote certain strategic sectors of the economy, and to achieve social goals. The important

sectors of the economy currently supported by the development banks are to promote

industrialization, particularly the high-technology industries, export-oriented industries,

infrastructure development and highly capital-intensive investments and the agriculture sector.

The Development banks also play a crucial role in the development of industries and housing

sectors.

LOVELY PROFESSIONAL UNIVERSITY 157