Page 157 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 157

Indirect Tax Laws

Notes are imported - stage subsequent to processing of goods is not relevant - (b) It is well settled that

the imported goods have to be assessed to duty in the condition in which they are imported.

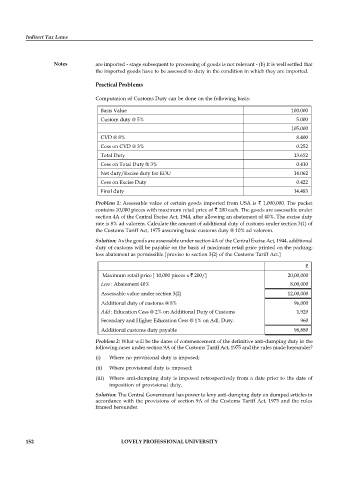

Practical Problems

Computation of Customs Duty can be done on the following basis:

Basis Value 100.000

Custom duty @ 5% 5.000

105.000

CVD @ 8% 8.400

Cess on CVD @ 3% 0.252

Total Duty 13.652

Cess on Total Duty @ 3% 0.410

Net duty/Excise duty for EOU 14.062

Cess on Excise Duty 0.422

Final duty 14.483

Problem 1: Assessable value of certain goods imported from USA is 1,000,000. The packet

contains 10,000 pieces with maximum retail price of 200 each. The goods are assessable under

section 4A of the Central Excise Act, 1944, after allowing an abatement of 40%. The excise duty

rate is 8% ad valorem. Calculate the amount of additional duty of customs under section 3(1) of

the Customs Tariff Act, 1975 assuming basic customs duty @ 10% ad valorem.

Solution: As the goods are assessable under section 4A of the Central Excise Act, 1944, additional

duty of customs will be payable on the basis of maximum retail price printed on the packing;

less abatement as permissible [proviso to section 3(2) of the Customs Tariff Act.]

Maximum retail price [ 10,000 pieces x 200/] 20,00,000

Less : Abatement 40% 8,00,000

Assessable value under section 3(2) 12,00,000

Additional duty of customs @ 8% 96,000

Add : Education Cess @ 2% on Additional Duty of Customs 1,920

Secondary and Higher Education Cess @ 1% on Adl. Duty. 960

Additional customs duty payable 98,880

Problem 2: What will be the dates of commencement of the definitive anti-dumping duty in the

following cases under section 9A of the Customs Tariff Act, 1975 and the rules made hereunder?

(i) Where no provisional duty is imposed;

(ii) Where provisional duty is imposed;

(iii) Where anti-dumping duty is imposed retrospectively from a date prior to the date of

imposition of provisional duty.

Solution: The Central Government has power to levy anti-dumping duty on dumped articles in

accordance with the provisions of section 9A of the Customs Tariff Act, 1975 and the rules

framed hereunder.

152 LOVELY PROFESSIONAL UNIVERSITY