Page 158 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 158

Unit 9: Valuation of Custom Goods

(i) In a case where no provisional duty is imposed, the date of commencement of anti- Notes

dumping duty will be the date of publication of notification, imposing anti-dumping duty

under section 9A(1), in the Official Gazette.

(ii) In a case where provisional duty is imposed under section 9A(2), the date of commencement

of anti-dumping duty will be the date of publication of notification, imposing provisional

duty under section 9A(2), in the Official Gazette.

(iii) In a case where anti-dumping duty is imposed retrospectively under section 9A (3) from a

date prior to the date of imposition of provisional duty, the date of commencement of

anti-dumping duty will be such prior date as may be notified in the notification imposing

anti-dumping duty retrospectively, but not beyond 90 days from the date of such notification

of provisional duty.

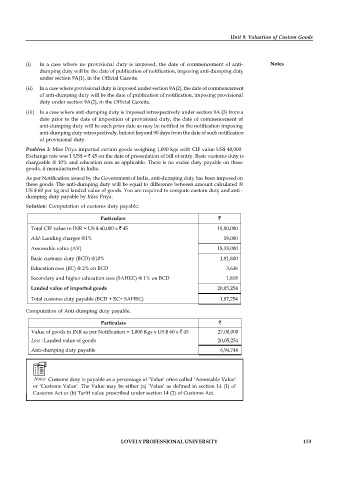

Problem 3: Miss Priya imported certain goods weighing 1,000 kgs with CIF value US$ 40,000.

Exchange rate was 1 US$ = 45 on the date of presentation of bill of entry. Basic customs duty is

chargeable @ 10% and education cess as applicable. There is no excise duty payable on these

goods, if manufactured in India.

As per Notification issued by the Government of India, anti-dumping duty has been imposed on

these goods. The anti-dumping duty will be equal to difference between amount calculated @

US $ 60 per kg and landed value of goods. You are required to compute custom duty and anti -

dumping duty payable by Miss Priya.

Solution: Computation of customs duty payable:

Particulars

Total CIF value in INR = US $ 40,000 x 45 18,00,000

Add: Landing charges @1% 18,000

Assessable value (AV) 18,18,000

Basic customs duty (BCD) @10% 1,81,800

Education cess (EC) @ 2% on BCD 3,636

Secondary and higher education cess (SAHEC) @ 1% on BCD 1,818

Landed value of imported goods 20,05,254

Total customs duty payable (BCD + EC+ SAHEC) 1,87,254

Computation of Anti-dumping duty payable:

Particulars

Value of goods in INR as per Notification = 1,000 Kgs x US $ 60 x 45 27,00,000

Less : Landed value of goods 20,05,254

Anti-dumping duty payable 6,94,746

Notes Customs duty is payable as a percentage of ‘Value’ often called ‘Assessable Value’

or ‘Customs Value’. The Value may be either (a) ‘Value’ as defined in section 14 (1) of

Customs Act or (b) Tariff value prescribed under section 14 (2) of Customs Act.

LOVELY PROFESSIONAL UNIVERSITY 153