Page 174 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 174

Unit 6: Technical Analysis

may continue to pay liberally but lose 50% of its value. If a stock is to be judged solely on Notes

its income, a non-dividend payer would have no value at all.

5. Technicians act more quickly to make commitments and to take profits and losses: They

are not concerned with maintaining a position in any market, any industry or any stock.

As a result, they are willing to take smaller gains in an up-market and accept quick losses

in a down market. Traders/technicians want to keep their money working at maximum

efficiency.

Technicians know that there is no real value to any stock and that price reflects supply and

demand, which are governed by hundreds of factors, rational and irrational. No one can

grasp and weigh them all, but to a surprising degree, the market does so automatically.

6. Technicians recognize that the more experience one has with the technical indicators, the

more alert one becomes to pitfalls and failure of investing: To be rewarding, technical

analysis requires attention and discipline, with quality stocks held for the long terms. The

duration can make up for timing mistakes. With technical approaches, the errors become

clear quickly.

7. Technicians insist that the market always repeats: What has happened before will probably

be repeated again; therefore, current movements can be used for future projection.

With all markets and almost all securities, there are cycles and trends which will occur

again and again. Technical analyses, especially charts, provide the best and most convenient

method of comparison.

8. Technicians believe that breakouts from previous trends are important signals: They indicate

a shift in that all-important supply and demand. When confirmed, breakouts are almost

always accurate signals to buy or sell.

9. Technicians recognize that the securities of a strong company are often weak and those of

a weak company may be strong: Technical analysis can quickly show when such situations

occur. These indicators always delineate between the company and the stock.

10. Technicians use charts to confirm fundamentals: When both agree, the odds are favourable

for profitable movement if the trend of the overall stock market is also favourable.

In view of the above comparison between technical and fundamental analysis, let us consider

some of the tools used by technical analysts to measure supply and demand and forecast security

prices.

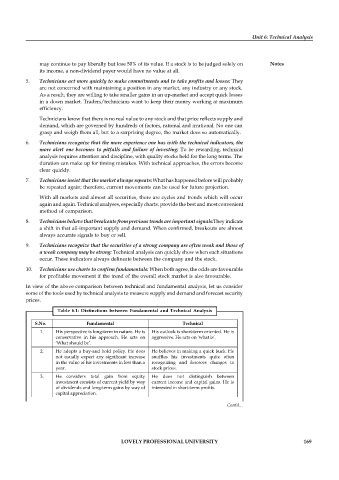

Table 6.1: Distinctions between Fundamental and Technical Analysis

S.No. Fundamental Technical

1. His perspective is long-term in nature. He is His outlook is short-term oriented. He is

conservative in his approach. He acts on aggressive. He acts on ‘what is’.

‘What should be’.

2. He adopts a buy-and hold policy. He does He believes in making a quick buck. He

not usually expect any significant increase snuffles his investments quite often

in the value of his investments in less than a recognizing and foresees changes in

year. stock prices.

3. He considers total gain from equity He does not distinguish between

investment consists of current yield by way current income and capital gains. He is

of dividends and long-term gains by way of interested in short-term profits.

capital appreciation.

4. He forecasts stock prices on the basis of He forecasts security prices by studying

Contd...

economic, industry and company statistics. patterns of supply of and demand for

The principal decision variables take the securities. Technical analysis is study of

form of earnings and dividends. He makes stock exchange information.

a judgment of the stock’s value with a risk-

return.

5. He uses tools of financial analysis and He uses mainly charges of financial

variables besides some quantitative

statistical forecasting techniques LOVELY PROFESSIONAL UNIVERSITY 169

tools.