Page 20 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 20

Unit 1: Introduction to Capital Market

(c) The syndicate member brokers operate the software through book-runners of the Notes

issue and through this book, the syndicate member brokers on behalf of themselves

or their clients' place orders.

(d) Bids are placed electronically through syndicate members and the information is

collected on line real-time until the bid date ends.

(e) In order to maintain transparency, the software provides visual graphs displaying

price v/s quantity on the terminals.

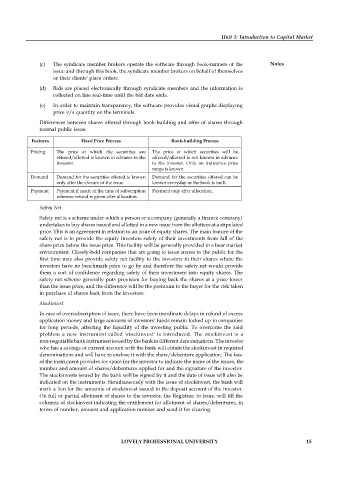

Differences between shares offered through book-building and offer of shares through

normal public issue:

Features Fixed Price Process Book-building Process

Pricing The price at which the securities are The price at which securities will be

offered/allotted is known in advance to the offered/allotted is not known in advance

investor. to the investor. Only an indicative price

range is known.

Demand Demand for the securities offered is known Demand for the securities offered can be

only after the closure of the issue. known everyday as the book is built.

Payment Payment if made at the time of subscription Payment only after allocation.

whereas refund is given after allocation.

Safety Net

Safety net is a scheme under which a person or a company (generally a finance company)

undertakes to buy shares issued and allotted in a new issue from the allottees at a stipulated

price. This is an agreement in relation to an issue of equity shares. The main feature of the

safety net is to provide the equity investors safety of their investments from fall of the

share price below the issue price. This facility will be generally provided in a bear market

environment. Closely-held companies that are going to issue snares to the public for the

first time may also provide safety net facility to the investors in their shares where the

investors have no benchmark price to go by and therefore the safety net would provide

them a sort of confidence regarding safety of their investment into equity shares. The

safety net scheme generally puts provision for buying back the shares at a price lower

than the issue price, and the difference will be the premium to the buyer for the risk taken

in purchase of shares back from the investors.

Stockinvest

In case of oversubscription of issue, there have been inordinate delays in refund of excess

application money and large amounts of investors' funds remain locked up in companies

for long periods, affecting the liquidity of the investing public. To overcome the said

problem a new instrument called 'stockinvest' is introduced. The stockinvest is a

non-negotiable bank instrument issued by the bank in different denominations. The investor

who has a savings or current account with the bank will obtain the stockinvest in required

denominations and will have to enclose it with the share/debenture application. The face

of the instrument provides for space for the investor to indicate the name of the issues, the

number and amount of shares/debentures applied for and the signature of the investor.

The stockinvests issued by the bank will be signed by it and the date of issue will also be

indicated on the instruments. Simultaneously with the issue of stockinvest, the bank will

mark a lien for the amounts of stockinvest issued in the deposit account of the investor.

On full or partial allotment of shares to the investor, the Registrar, to issue, will fill the

columns of stockinvest indicating the entitlement for allotment of shares/debentures, in

terms of number, amount and application number and send it for clearing.

LOVELY PROFESSIONAL UNIVERSITY 15