Page 228 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 228

Unit 8: Derivatives

3. Time Spreads: There is a relationship between the spot price and the futures price of Notes

contract. The relationship also exists between prices of futures contracts, which are on the

same commodity or instrument but which have different expiry dates. The difference

between the prices of two contracts is known as the ‘time spread’, which is the basis of

futures market.

4. Margins: Since the clearing house undertakes the default risk, to protect itself from this

risk, the clearing house requires the participants to keep margin money, normally ranging

from 5% to 10% of the face value of the contract.

Uses of Futures Contracting

The uses of futures contracting are as follows:

1. Hedging: The classic hedging application would be that of a wheat farmer futures selling

his harvest at a known price in order to eliminate price risk. Conversely, a bread factory

may want to buy wheat futures in order to assist production planning without the risk of

price fluctuations.

2. Price discovery: Price discovery is the use of futures prices to predict spot price that will

prevail in the future. These predictions are useful for production decisions involving the

various commodities.

3. Speculation: If a speculator has information or analysis which forecasts an upturn in a

price, then he can go long on the futures market instead of the cash market, wait for the

price rise, and then take a reversing transaction. The use of futures market here gives

leverage to the speculator.

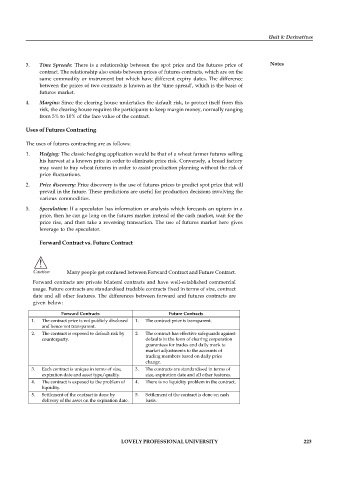

Forward Contract vs. Future Contract

!

Caution Many people get confused between Forward Contract and Future Contract.

Forward contracts are private bilateral contracts and have well-established commercial

usage. Future contracts are standardised tradable contracts fixed in terms of size, contract

date and all other features. The differences between forward and futures contracts are

given below:

Forward Contracts Future Contracts

1. The contract price is not publicly disclosed 1. The contract price is transparent.

and hence not transparent.

2. The contract is exposed to default risk by 2. The contract has effective safeguards against

counterparty. defaults in the form of clearing corporation

guarantees for trades and daily mark to

market adjustments to the accounts of

trading members based on daily price

change.

3. Each contract is unique in terms of size, 3. The contracts are standardised in terms of

expiration date and asset type/quality. size, expiration date and all other features.

4. The contract is exposed to the problem of 4. There is no liquidity problem in the contract.

liquidity.

5. Settlement of the contract is done by 5. Settlement of the contract is done on cash

delivery of the asset on the expiration date. basis.

LOVELY PROFESSIONAL UNIVERSITY 223