Page 260 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 260

Unit 9: Portfolio Management

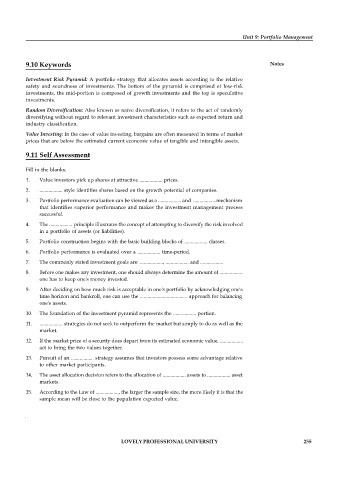

9.10 Keywords Notes

Investment Risk Pyramid: A portfolio strategy that allocates assets according to the relative

safety and soundness of investments. The bottom of the pyramid is comprised of low-risk

investments, the mid-portion is composed of growth investments and the top is speculative

investments.

Random Diversification: Also known as naïve diversification, it refers to the act of randomly

diversifying without regard to relevant investment characteristics such as expected return and

industry classification.

Value Investing: In the case of value investing, bargains are often measured in terms of market

prices that are below the estimated current economic value of tangible and intangible assets.

9.11 Self Assessment

Fill in the blanks:

1. Value investors pick up shares at attractive .................. prices.

2. .................. style identifies shares based on the growth potential of companies.

3. Portfolio performance evaluation can be viewed as a .................. and ..................mechanism

that identifies superior performance and makes the investment management process

successful.

4. The .................. principle illustrates the concept of attempting to diversify the risk involved

in a portfolio of assets (or liabilities).

5. Portfolio construction begins with the basic building blocks of .................. classes.

6. Portfolio performance is evaluated over a .................. time-period.

7. The commonly stated investment goals are: .................., .................. and ..................

8. Before one makes any investment, one should always determine the amount of ..................

one has to keep one's money invested.

9. After deciding on how much risk is acceptable in one's portfolio by acknowledging one's

time horizon and bankroll, one can use the ..................................... approach for balancing

one's assets.

10. The foundation of the investment pyramid represents the .................. portion.

11. .................. strategies do not seek to outperform the market but simply to do as well as the

market.

12. If the market price of a security does depart from its estimated economic value, ..................

act to bring the two values together.

13. Pursuit of an .................. strategy assumes that investors possess some advantage relative

to other market participants.

14. The asset allocation decision refers to the allocation of .................. assets to .................. asset

markets.

15. According to the Law of .................., the larger the sample size, the more likely it is that the

sample mean will be close to the population expected value.

LOVELY PROFESSIONAL UNIVERSITY 255