Page 30 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 30

Unit 1: Introduction to Capital Market

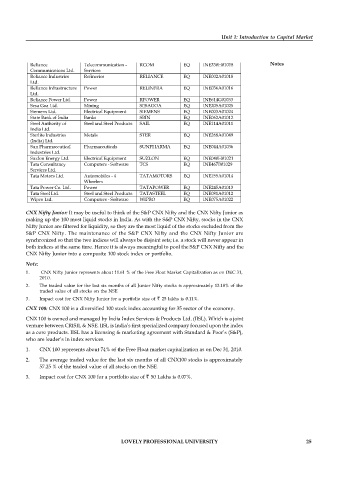

Reliance Telecommunication - RCOM EQ INE330H01018 Notes

Communications Ltd. Services

Reliance Industries Refineries RELIANCE EQ INE002A01018

Ltd.

Reliance Infrastructure Power RELINFRA EQ INE036A01016

Ltd.

Reliance Power Ltd. Power RPOWER EQ INE614G01033

Sesa Goa Ltd. Mining SESAGOA EQ INE205A01025

Siemens Ltd. Electrical Equipment SIEMENS EQ INE003A01024

State Bank of India Banks SBIN EQ INE062A01012

Steel Authority of Steel and Steel Products SAIL EQ INE114A01011

India Ltd.

Sterlite Industries Metals STER EQ INE268A01049

(India) Ltd.

Sun Pharmaceutical Pharmaceuticals SUNPHARMA EQ INE044A01036

Industries Ltd.

Suzlon Energy Ltd. Electrical Equipment SUZLON EQ INE040H01021

Tata Consultancy Computers - Software TCS EQ INE467B01029

Services Ltd.

Tata Motors Ltd. Automobiles - 4 TATAMOTORS EQ INE155A01014

Wheelers

Tata Power Co. Ltd. Power TATAPOWER EQ INE245A01013

Tata Steel Ltd. Steel and Steel Products TATASTEEL EQ INE081A01012

Wipro Ltd. Computers - Software WIPRO EQ INE075A01022

CNX Nifty Junior: It may be useful to think of the S&P CNX Nifty and the CNX Nifty Junior as

making up the 100 most liquid stocks in India. As with the S&P CNX Nifty, stocks in the CNX

Nifty Junior are filtered for liquidity, so they are the most liquid of the stocks excluded from the

S&P CNX Nifty. The maintenance of the S&P CNX Nifty and the CNX Nifty Junior are

synchronized so that the two indices will always be disjoint sets; i.e. a stock will never appear in

both indices at the same time. Hence it is always meaningful to pool the S&P CNX Nifty and the

CNX Nifty Junior into a composite 100 stock index or portfolio.

Note:

1. CNX Nifty Junior represents about 11.61 % of the Free Float Market Capitalization as on DEC 31,

2010.

2. The traded value for the last six months of all Junior Nifty stocks is approximately 13.18% of the

traded value of all stocks on the NSE

3. Impact cost for CNX Nifty Junior for a portfolio size of 25 lakhs is 0.11%.

CNX 100: CNX 100 is a diversified 100 stock index accounting for 35 sector of the economy.

CNX 100 is owned and managed by India Index Services & Products Ltd. (IISL). Which is a joint

venture between CRISIL & NSE. IISL is India’s first specialized company focused upon the index

as a core products. IISL has a licensing & marketing agreement with Standard & Poor’s (S&P),

who are leader’s in index services.

1. CNX 100 represents about 74% of the Free Float market capitalization as on Dec 31, 2010.

2. The average traded value for the last six months of all CNX100 stocks is approximately

57.25 % of the traded value of all stocks on the NSE.

3. Impact cost for CNX 100 for a portfolio size of 50 Lakhs is 0.07%.

LOVELY PROFESSIONAL UNIVERSITY 25