Page 316 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 316

Unit 12: Models

12. Sharpe assumed that, the return on a security could be regarded as being ............... related Notes

to a single index like the market index.

13. Predicting the value of beta can be a ............... process.

14. In Markowitz Model, it is assumed that for a given risk level, investors prefer ...............

returns to ............... returns.

15. In Markowitz Model, to build an efficient portfolio an ............... level is chosen, and assets

are substituted until the portfolio combination with the smallest variance at return level

is found.

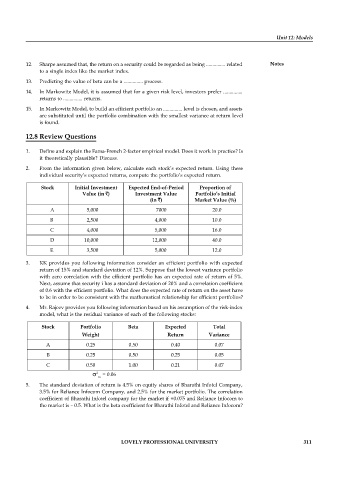

12.8 Review Questions

1. Define and explain the Fama-French 2-factor empirical model. Does it work in practice? Is

it theoretically plausible? Discuss.

2. From the information given below, calculate each stock’s expected return. Using these

individual security’s expected returns, compute the portfolio’s expected return.

Stock Initial Investment Expected End-of-Period Proportion of

Value (in ) Investment Value Portfolio’s Initial

(in ) Market Value (%)

A 5,000 7000 20.0

B 2,500 4,000 10.0

C 4,000 5,000 16.0

D 10,000 12,000 40.0

E 3,500 5,000 12.0

3. KK provides you following information consider an efficient portfolio with expected

return of 15% and standard deviation of 12%. Suppose that the lowest variance portfolio

with zero correlation with the efficient portfolio has an expected rate of return of 5%.

Next, assume that security i has a standard deviation of 20% and a correlation coefficient

of 0.6 with the efficient portfolio. What does the expected rate of return on the asset have

to be in order to be consistent with the mathematical relationship for efficient portfolios?

4. Mr. Rajeev provides you following information based on his assumption of the risk-index

model, what is the residual variance of each of the following stocks:

Stock Portfolio Beta Expected Total

Weight Return Variance

A 0.25 0.50 0.40 0.07

B 0.25 0.50 0.25 0.05

C 0.50 1.00 0.21 0.07

2 m = 0.06

5. The standard deviation of return is 4.5% on equity shares of Bharathi Infotel Company,

3.5% for Reliance Infocom Company, and 2.5% for the market portfolio. The correlation

coefficient of Bharathi Infotel company for the market if +0.075 and Reliance Infocom to

the market is – 0.5. What is the beta coefficient for Bharathi Infotel and Reliance Infocom?

LOVELY PROFESSIONAL UNIVERSITY 311