Page 323 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 323

Security Analysis and Portfolio Management

Notes Solution:

The dollar-weighted return would be calculated by solving the following equation for r

100 = [–5/(1 + r)] + [103/(1 + r) ]

2

r = – 0.98% which is a semi-quarterly rate of return.

This can be converted into a quarterly rate of return by adding 1 to it, squaring this value and

then subtracting 1 from the square, resulting in a quarterly return of [1 + (–0.0098)2 – 1] = –1.95%.

Example: You have invested 10,000 in a portfolio of securities on January 1. Each

month thereafter you have started adding 1000 to your Portfolio Fund Account. Suppose, by

December 31, the fund has appreciated to a higher value. How do you verify performance of

your portfolio? Suppose if you have withdrawn some money in the middle. Still, the fund has

appreciated. How much of the said appreciation comes from your contribution and how much

from increased share value?

Solution:

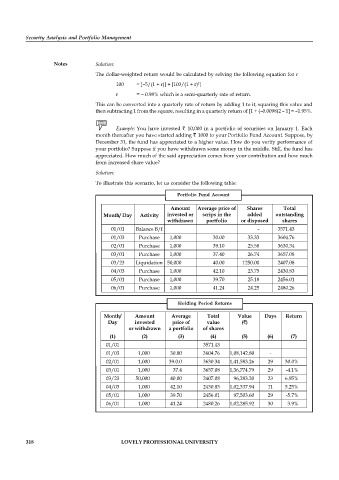

To illustrate this scenario, let us consider the following table:

Portfolio Fund Account

Amount Average price of Shares Total

Month/ Day Activity invested or scrips in the added outstanding

withdrawn portfolio or disposed shares

01/01 Balance B/f - 3571.43

01/03 Purchase 1,000 30.00 33.33 3604.76

02/01 Purchase 1,000 39.10 25.58 3630.34

03/01 Purchase 1,000 37.40 26.74 3657.08

03/23 Liquidation 50,000 40.00 1250.00 2407.08

04/03 Purchase 1,000 42.10 23.75 2430.83

05/01 Purchase 1,000 39.70 25.18 2456.01

06/01 Purchase 1,000 41.24 24.25 2480.26

Holding Period Returns

Month/ Amount Average Total Value Days Return

Day invested price of value ( )

or withdrawn a portfolio of shares

(1) (2) (3) (4) (5) (6) (7)

01/01 3571.43

01/03 1,000 30.00 3604.76 1,08,142.80 -

02/01 1,000 39.0.0 3630.34 1,41,583.26 29 30.0%

03/01 1,000 37.4 3657.08 1,36,774.79 29 -4.1%

03/23 50,000 40.00 2407.08 96,283.20 23 6.95%

04/03 1,000 42.10 2430.83 1,02,337.94 11 5.25%

05/01 1,000 39.70 2456.01 97,503.60 29 -5.7%

06/01 1,000 41.24 2480.26 1,02,285.92 30 3.9%

318 LOVELY PROFESSIONAL UNIVERSITY