Page 344 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 344

(5)

(8)

(3)

(4)

(1)

(6)

(2)

(7)

Value of

Stock Value of

Total

Value of

Price

Action

of Constant (4): (3)

No. of

Index Buy-and- Conservative Aggressive Total Value Ratio Revaluation Shares

Hold

Portfolio

Portfolio

Ratio

Strategy (Col.5-Col.4) (Col.8xCol.1) Portfolio in

(800 shares (Col.3+Col.4) Aggressive

xCol.1) Portfolio

(Rs.) (Rs.) (Rs.) (Rs.)

Unit 14: Portfolio Revision

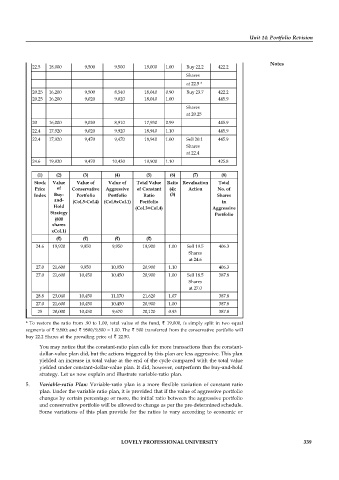

25 20,000 10,000 10,000 20,000 1.00 400

23 18,400 10,000 9,200 19,200 0.92 400

22.5 18,000 10,000 9,000 19,000 0.90 400

Notes

22.5 18,000 9,500 9,500 19,000 1.00 Buy 22.2 422.2

Shares

at 22.5 *

20.25 16,200 9,500 8,540 18,040 0.90 Buy 23.7 422.2

20.25 16,200 9,020 9,020 18,040 1.00 445.9

Shares

at 20.25

20 16,000 9,020 8,910 17,930 0.99 445.9

22.4 17,920 9,020 9,920 18,940 1.10 445.9

22.4 17,920 9,470 9,470 18,940 1.00 Sell 20.1 445.9

Shares

at 22.4

24.6 19,920 9,470 10,430 19,900 1.10 425.8

(1) (2) (3) (4) (5) (6) (7) (8)

Stock Value Value of Value of Total Value Ratio Revaluation Total

Price of Conservative Aggressive of Constant (4): Action No. of

Index Buy- Portfolio Portfolio Ratio (3) Shares

and-

(Col.5-Col.4) (Col.8xCol.1) Portfolio in

Hold (Col.3+Col.4) Aggressive

Strategy Portfolio

(800

shares

xCol.1)

( ) ( ) ( ) ( )

24.6 19,920 9,950 9,950 19,900 1.00 Sell 19.5 406.3

Shares

at 24.6

27.0 21,600 9,950 10,950 20,900 1.10 406.3

27.0 21,600 10,450 10,450 20,900 1.00 Sell 18.5 387.8

Shares

at 27.0

28.8 23,040 10,450 11,170 21,620 1.07 387.8

27.0 21,600 10,450 10,450 20,900 1.00 387.8

25 20,000 10,450 9,670 20,120 0.93 387.8

* To restore the ratio from .90 to 1.00, total value of the fund, 19,000, is simply split in two equal

segments of 9,500; and 9500/9,500 = 1.00. The 500 transferred from the conservative portfolio will

buy 22.2 Shares at the prevailing price of 22.50.

You may notice that the constant-ratio plan calls for more transactions than the constant-

dollar-value plan did, but the actions triggered by this plan are less aggressive. This plan

yielded an increase in total value at the end of the cycle compared with the total value

yielded under constant-dollar-value plan. It did, however, outperform the buy-and-hold

strategy. Let us now explain and illustrate variable-ratio plan.

5. Variable-ratio Plan: Variable-ratio plan is a more flexible variation of constant ratio

plan. Under the variable ratio plan, it is provided that if the value of aggressive portfolio

changes by certain percentage or more, the initial ratio between the aggressive portfolio

and conservative portfolio will be allowed to change as per the pre-determined schedule.

Some variations of this plan provide for the ratios to vary according to economic or

LOVELY PROFESSIONAL UNIVERSITY 339