Page 96 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 96

Unit 2: Risk and Return

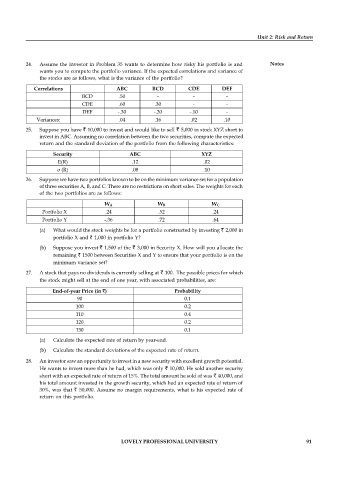

24. Assume the investor in Problem 35 wants to determine how risky his portfolio is and Notes

wants you to compute the portfolio variance. If the expected correlations and variance of

the stocks are as follows, what is the variance of the portfolio?

Correlations ABC BCD CDE DEF

BCD .50 - - -

CDE .60 .30 - -

DEF -.30 -.20 -.10 -

Variances: .04 .16 .02 .10

25. Suppose you have 10,000 to invest and would like to sell 5,000 in stock XYZ short to

invest in ABC. Assuming no correlation between the two securities, compute the expected

return and the standard deviation of the portfolio from the following characteristics:

Security ABC XYZ

E(R) .12 .02

σ (R) .08 .10

26. Suppose we have two portfolios known to be on the minimum variance set for a population

of three securities A, B, and C. There are no restrictions on short sales. The weights for each

of the two portfolios are as follows:

W A W B W C

Portfolio X .24 .52 .24

Portfolio Y -.36 .72 .64

(a) What would the stock weights be for a portfolio constructed by investing 2,000 in

portfolio X and 1,000 in portfolio Y?

(b) Suppose you invest 1,500 of the 3,000 in Security X. How will you allocate the

remaining 1500 between Securities X and Y to ensure that your portfolio is on the

minimum variance set?

27. A stock that pays no dividends is currently selling at 100. The possible prices for which

the stock might sell at the end of one year, with associated probabilities, are:

End-of-year Price (in ) Probability

90 0.1

100 0.2

110 0.4

120 0.2

130 0.1

(a) Calculate the expected rate of return by year-end.

(b) Calculate the standard deviations of the expected rate of return.

28. An investor saw an opportunity to invest in a new security with excellent growth potential.

He wants to invest more than he had, which was only 10,000. He sold another security

short with an expected rate of return of 15%. The total amount he sold of was 40,000, and

his total amount invested in the growth security, which had an expected rate of return of

30%, was that 50,000. Assume no margin requirements, what is his expected rate of

return on this portfolio.

LOVELY PROFESSIONAL UNIVERSITY 91