Page 19 - DCOM505_WORKING_CAPITAL_MANAGEMENT

P. 19

Working Capital Management

Notes 12. How can the differences between the returns on current and fixed assets and the cost of

current liabilities and long-term funds be used to determine how best to change a firm’s

net working capital?

13. “Uncertainty makes it difficult for a financial manager to predict the company’s

requirements for short-term funds”. Discuss. What steps can the financial manager take to

minimize the resulting risks to the company?

14. Why is no single working capital investment and financing policy necessarily optimal for

all firms? What additional factors need to be considered in establishing a working capital

policy?

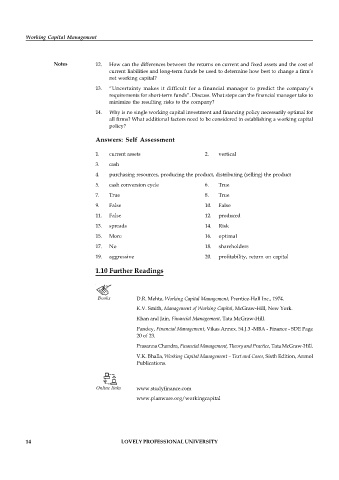

Answers: Self Assessment

1. current assets 2. vertical

3. cash

4. purchasing resources, producing the product, distributing (selling) the product

5. cash conversion cycle 6. True

7. True 8. True

9. False 10. False

11. False 12. produced

13. spreads 14. Risk

15. More 16. optimal

17. No 18. shareholders

19. aggressive 20. profitability, return on capital

1.10 Further Readings

Books D.R. Mehta, Working Capital Management, Prentice-Hall Inc., 1974.

K.V. Smith, Management of Working Capital, McGraw-Hill, New York.

Khan and Jain, Financial Management, Tata McGraw-Hill.

Pandey, Financial Management, Vikas Annex. 54.J.3 -MBA - Finance - SDE Page

20 of 23.

Prasanna Chandra, Financial Management, Theory and Practice, Tata McGraw-Hill.

V.K. Bhalla, Working Capital Management – Text and Cases, Sixth Edition, Anmol

Publications.

Online links www.studyfinance.com

www.planware.org/workingcapital

14 LOVELY PROFESSIONAL UNIVERSITY