Page 206 - DCOM505_WORKING_CAPITAL_MANAGEMENT

P. 206

Unit 12: Inventory Management

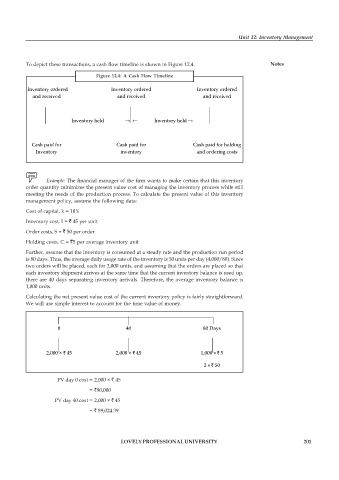

To depict these transactions, a cash flow timeline is shown in Figure 12.4. Notes

Figure 12.4: A Cash Flow Timeline

Inventory ordered Inventory ordered Inventory ordered

and received and received and received

Inventory held → ← Inventory held →

Cash paid for Cash paid for Cash paid for holding

Inventory inventory and ordering costs

Example: The financial manager of the firm wants to make certain that this inventory

order quantity minimizes the present value cost of managing the inventory process while still

meeting the needs of the production process. To calculate the present value of this inventory

management policy, assume the following data:

Cost of capital, k = 10%

Inventory cost, I = ` 45 per unit

Order costs, S = ` 50 per order

Holding costs, C = `5 per average inventory unit

Further, assume that the inventory is consumed at a steady rate and the production run period

is 80 days. Thus, the average daily usage rate of the inventory is 50 units per day (4,000/80). Since

two orders will be placed, each for 2,000 units, and assuming that the orders are placed so that

each inventory shipment arrives at the same time that the current inventory balance is used up,

there are 40 days separating inventory arrivals. Therefore, the average inventory balance is

1,000 units.

Calculating the net present value cost of the current inventory policy is fairly straightforward.

We will use simple interest to account for the time value of money.

0 40 80 Days

2,000 × ` 45 2,000 × ` 45 1,000 ` 5

2 ` 50

PV day 0 cost = 2,000 × ` 45

= `90,000

PV day 40 cost = 2,000 × ` 45

= ` 89,024.39

LOVELY PROFESSIONAL UNIVERSITY 201