Page 123 - DCOM508_CORPORATE_TAX_PLANNING

P. 123

Corporate Tax Planning

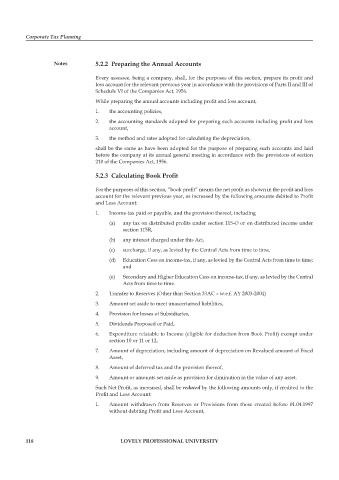

Notes 5.2.2 Preparing the Annual Accounts

Every assessee, being a company, shall, for the purposes of this section, prepare its profi t and

loss account for the relevant previous year in accordance with the provisions of Parts II and III of

Schedule VI of the Companies Act, 1956.

While preparing the annual accounts including profit and loss account,

1. the accounting policies,

2. the accounting standards adopted for preparing such accounts including profit and loss

account,

3. the method and rates adopted for calculating the depreciation,

shall be the same as have been adopted for the purpose of preparing such accounts and laid

before the company at its annual general meeting in accordance with the provisions of section

210 of the Companies Act, 1956.

5.2.3 Calculating Book Profi t

For the purposes of this section, “book profit” means the net profit as shown in the profit and loss

account for the relevant previous year, as increased by the following amounts debited to Profi t

and Loss Account:

1. Income-tax paid or payable, and the provision thereof, including

(a) any tax on distributed profits under section 115-O or on distributed income under

section 115R,

(b) any interest charged under this Act,

(c) surcharge, if any, as levied by the Central Acts from time to time,

(d) Education Cess on income-tax, if any, as levied by the Central Acts from time to time;

and

(e) Secondary and Higher Education Cess on income-tax, if any, as levied by the Central

Acts from time to time.

2. Transfer to Reserves (Other than Section 33AC – w.e.f. AY 2003-2004)

3. Amount set aside to meet unascertained liabilities,

4. Provision for losses of Subsidiaries,

5. Dividends Proposed or Paid,

6. Expenditure relatable to Income (eligible for deduction from Book Profit) exempt under

section 10 or 11 or 12,

7. Amount of depreciation, including amount of depreciation on Revalued amount of Fixed

Asset,

8. Amount of deferred tax and the provision thereof,

9. Amount or amounts set aside as provision for diminution in the value of any asset.

Such Net Profit, as increased, shall be reduced by the following amounts only, if credited to the

Profit and Loss Account:

1. Amount withdrawn from Reserves or Provisions from those created before 01.04.1997

without debiting Profit and Loss Account,

118 LOVELY PROFESSIONAL UNIVERSITY