Page 119 - DCOM508_CORPORATE_TAX_PLANNING

P. 119

Corporate Tax Planning

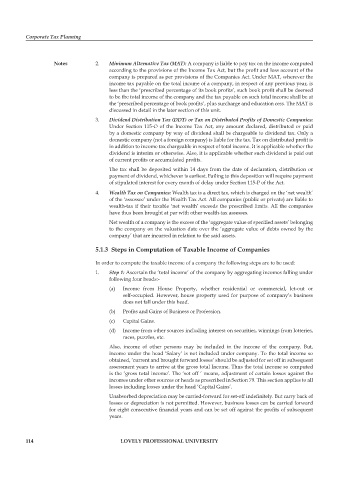

Notes 2. Minimum Alternative Tax (MAT): A company is liable to pay tax on the income computed

according to the provisions of the Income Tax Act, but the profit and loss account of the

company is prepared as per provisions of the Companies Act. Under MAT, wherever the

income tax payable on the total income of a company, in respect of any previous year, is

less than the ‘prescribed percentage of its book profits’, such book profit shall be deemed

to be the total income of the company and the tax payable on such total income shall be at

the ‘prescribed percentage of book profits’, plus surcharge and education cess. The MAT is

discussed in detail in the later section of this unit.

3. Dividend Distribution Tax (DDT) or Tax on Distributed Profits of Domestic Companies:

Under Section 115-O of the Income Tax Act, any amount declared, distributed or paid

by a domestic company by way of dividend shall be chargeable to dividend tax. Only a

domestic company (not a foreign company) is liable for the tax. Tax on distributed profi t is

in addition to income tax chargeable in respect of total income. It is applicable whether the

dividend is interim or otherwise. Also, it is applicable whether such dividend is paid out

of current profits or accumulated profi ts.

The tax shall be deposited within 14 days from the date of declaration, distribution or

payment of dividend, whichever is earliest. Failing to this deposition will require payment

of stipulated interest for every month of delay under Section 115-P of the Act.

4. Wealth Tax on Companies: Wealth tax is a direct tax, which is charged on the ‘net wealth’

of the ‘assessee’ under the Wealth Tax Act. All companies (public or private) are liable to

wealth-tax if their taxable ‘net wealth’ exceeds the prescribed limits. All the companies

have thus been brought at par with other wealth-tax assesses.

Net wealth of a company is the excess of the ‘aggregate value of specified assets’ belonging

to the company on the valuation date over the ‘aggregate value of debts owned by the

company’ that are incurred in relation to the said assets.

5.1.3 Steps in Computation of Taxable Income of Companies

In order to compute the taxable income of a company the following steps are to be used:

1. Step 1: Ascertain the ‘total income’ of the company by aggregating incomes falling under

following four heads:-

(a) Income from House Property, whether residential or commercial, let-out or

self-occupied. However, house property used for purpose of company’s business

does not fall under this head.

(b) Profits and Gains of Business or Profession.

(c) Capital Gains.

(d) Income from other sources including interest on securities, winnings from lotteries,

races, puzzles, etc.

Also, income of other persons may be included in the income of the company. But,

income under the head ‘Salary’ is not included under company. To the total income so

obtained, ‘current and brought forward losses’ should be adjusted for set off in subsequent

assessment years to arrive at the gross total Income. Thus the total income so computed

is the ‘gross total income’. The ‘set off ‘ means, adjustment of certain losses against the

incomes under other sources or heads as prescribed in Section 79. This section applies to all

losses including losses under the head ‘Capital Gains’.

Unabsorbed depreciation may be carried-forward for set-off indefinitely. But carry back of

losses or depreciation is not permitted. However, business losses can be carried forward

for eight consecutive financial years and can be set off against the profits of subsequent

years.

114 LOVELY PROFESSIONAL UNIVERSITY