Page 215 - DCOM508_CORPORATE_TAX_PLANNING

P. 215

Corporate Tax Planning

Notes 2. As per existing tax provisions, income from dividends is tax free in the hands of the

investor. There is a levy of 15% of the dividend declared as distribution tax. This tax

is paid out of the profits/reserves of the company declaring the dividend.

3. The provisions of this Section applies to a domestic company for any assessment year,

on an amount declared, distributed or paid by such company by way of dividends

(whether interim or otherwise).

4. The Company is required to pay the Dividend Distribution Tax within 14 days from

the date of declaration or distribution or payment of any dividend whichever is

earlier.

5. The said dividend distribution tax is in addition to the income tax chargeable on the

total income of the Company and the same shall be payable @15% and the same shall

be increased by Surcharge @10%, and such aggregate of tax and surcharge shall be

further increased by an Education cess @2% and higher education cess 1% .

6. The Section applies to dividend payments made either out of current or accumulated

profi ts.

7. The dividend so paid will be eligible for exemption for the shareholders under

Section 10(34).

8. The Dividend Distribution Tax is payable by a Domestic Company even if no income-

tax is payable on its total income.

9.3.2 Special Provisions Relating to Tax on Distributed Income

Section 115R states that any amount of income distributed by (i) a specified company, or (ii) a

mutual fund to unit holders shall be chargeable to tax and such specified company or mutual

fund shall be liable to pay additional income tax on such distributed income at the following

rate:

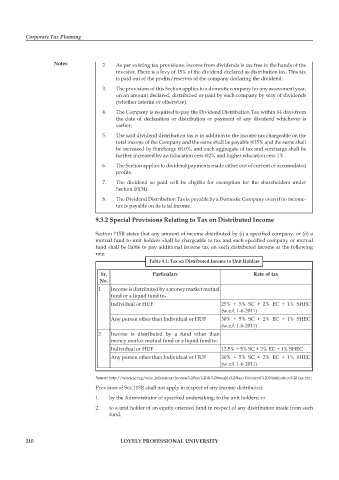

Table 9.1: Tax on Distributed Income to Unit Holders

Sr. Particulars Rate of tax

No.

1 Income is distributed by a money market mutual

fund or a liquid fund to-

Individual or HUF 25% + 5% SC + 2% EC + 1% SHEC

(w.e.f. 1-6-2011)

Any person other than Individual or HUF 30% + 5% SC + 2% EC + 1% SHEC

(w.e.f. 1-6-2011)

2 Income is distributed by a fund other than

money market mutual fund or a liquid fund to-

Individual or HUF 12.5% + 5% SC + 2% EC + 1% SHEC

Any person other than Individual or HUF 30% + 5% SC + 2% EC + 1% SHEC

(w.e.f. 1-6-2011)

Source: http://wircicai.org/wirc_referencer/income%20tax%20&%20wealth%20tax/Dividend%20Distribution%20Tax.htm

Provision of Sec.115R shall not apply in respect of any income distributed:

1. by the Administrator of specified undertaking, to the unit holders; or

2. to a unit holder of an equity oriented fund in respect of any distribution made from such

fund.

210 LOVELY PROFESSIONAL UNIVERSITY