Page 293 - DCOM508_CORPORATE_TAX_PLANNING

P. 293

Corporate Tax Planning

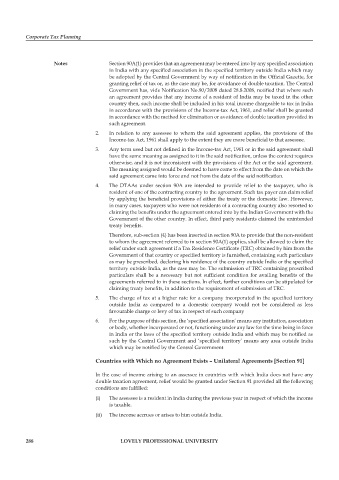

Notes Section 90A(1) provides that an agreement may be entered into by any specifi ed association

in India with any specifi ed association in the specifi ed territory outside India which may

be adopted by the Central Government by way of notification in the Official Gazette, for

granting relief of tax or, as the case may be, for avoidance of double taxation. The Central

Government has, vide Notification No.90/2008 dated 28.8.2008, notified that where such

an agreement provides that any income of a resident of India may be taxed in the other

country then, such income shall be included in his total income chargeable to tax in India

in accordance with the provisions of the Income-tax Act, 1961, and relief shall be granted

in accordance with the method for elimination or avoidance of double taxation provided in

such agreement.

2. In relation to any assessee to whom the said agreement applies, the provisions of the

Income-tax Act, 1961 shall apply to the extent they are more beneficial to that assessee.

3. Any term used but not defined in the Income-tax Act, 1961 or in the said agreement shall

have the same meaning as assigned to it in the said notification, unless the context requires

otherwise, and it is not inconsistent with the provisions of the Act or the said agreement.

The meaning assigned would be deemed to have come to effect from the date on which the

said agreement came into force and not from the date of the said notifi cation.

4. The DTAAs under section 90A are intended to provide relief to the taxpayer, who is

resident of one of the contracting country to the agreement. Such tax payer can claim relief

by applying the beneficial provisions of either the treaty or the domestic law. However,

in many cases, taxpayers who were not residents of a contracting country also resorted to

claiming the benefits under the agreement entered into by the Indian Government with the

Government of the other country. In effect, third party residents claimed the unintended

treaty benefi ts.

Therefore, sub-section (4) has been inserted in section 90A to provide that the non-resident

to whom the agreement referred to in section 90A(1) applies, shall be allowed to claim the

relief under such agreement if a Tax Residence Certificate (TRC) obtained by him from the

Government of that country or specified territory is furnished, containing such particulars

as may be prescribed, declaring his residence of the country outside India or the specifi ed

territory outside India, as the case may be. The submission of TRC containing prescribed

particulars shall be a necessary but not sufficient condition for availing benefits of the

agreements referred to in these sections. In effect, further conditions can be stipulated for

claiming treaty benefits, in addition to the requirement of submission of TRC.

5. The charge of tax at a higher rate for a company incorporated in the specifi ed territory

outside India as compared to a domestic company would not be considered as less

favourable charge or levy of tax in respect of such company

6. For the purpose of this section, the ‘specified association’ means any institution, association

or body, whether incorporated or not, functioning under any law for the time being in force

in India or the laws of the specifi ed territory outside India and which may be notifi ed as

such by the Central Government and ‘specified territory’ means any area outside India

which may be notified by the Central Government

Countries with Which no Agreement Exists – Unilateral Agreements [Section 91]

In the case of income arising to an assessee in countries with which India does not have any

double taxation agreement, relief would be granted under Section 91 provided all the following

conditions are fulfi lled:

(i) The assessee is a resident in India during the previous year in respect of which the income

is taxable.

(ii) The income accrues or arises to him outside India.

288 LOVELY PROFESSIONAL UNIVERSITY