Page 294 - DCOM508_CORPORATE_TAX_PLANNING

P. 294

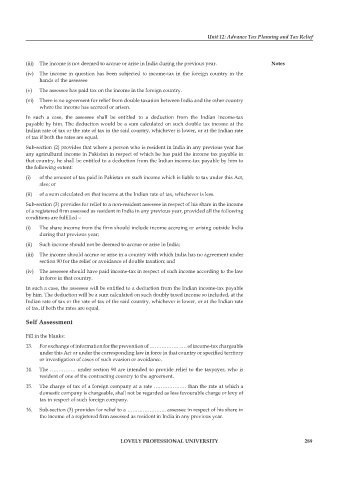

Unit 12: Advance Tax Planning and Tax Relief

(iii) The income is not deemed to accrue or arise in India during the previous year. Notes

(iv) The income in question has been subjected to income-tax in the foreign country in the

hands of the assessee

(v) The assessee has paid tax on the income in the foreign country.

(vi) There is no agreement for relief from double taxation between India and the other country

where the income has accrued or arisen.

In such a case, the assessee shall be entitled to a deduction from the Indian income-tax

payable by him. The deduction would be a sum calculated on such double tax income at the

Indian rate of tax or the rate of tax in the said country, whichever is lower, or at the Indian rate

of tax if both the rates are equal.

Sub-section (2) provides that where a person who is resident in India in any previous year has

any agricultural income in Pakistan in respect of which he has paid the income tax payable in

that country, he shall be entitled to a deduction from the Indian income-tax payable by him to

the following extent:

(i) of the amount of tax paid in Pakistan on such income which is liable to tax under this Act,

also; or

(ii) of a sum calculated on that income at the Indian rate of tax, whichever is less.

Sub-section (3) provides for relief to a non-resident assessee in respect of his share in the income

of a registered firm assessed as resident in India in any previous year, provided all the following

conditions are fulfi lled –

(i) The share income from the firm should include income accruing or arising outside India

during that previous year;

(ii) Such income should not be deemed to accrue or arise in India;

(iii) The income should accrue or arise in a country with which India has no agreement under

section 90 for the relief or avoidance of double taxation; and

(iv) The assessee should have paid income-tax in respect of such income according to the law

in force in that country.

In such a case, the assessee will be entitled to a deduction from the Indian income-tax payable

by him. The deduction will be a sum calculated on such doubly taxed income so included, at the

Indian rate of tax or the rate of tax of the said country, whichever is lower, or at the Indian rate

of tax, if both the rates are equal.

Self Assessment

Fill in the blanks:

13. For exchange of information for the prevention of …………………. of income-tax chargeable

under this Act or under the corresponding law in force in that country or specifi ed territory

or investigation of cases of such evasion or avoidance.

14. The …………… under section 90 are intended to provide relief to the taxpayer, who is

resident of one of the contracting country to the agreement.

15. The charge of tax of a foreign company at a rate ………………. than the rate at which a

domestic company is chargeable, shall not be regarded as less favourable charge or levy of

tax in respect of such foreign company.

16. Sub-section (3) provides for relief to a ………………….. assessee in respect of his share in

the income of a registered firm assessed as resident in India in any previous year.

LOVELY PROFESSIONAL UNIVERSITY 289