Page 47 - DCOM509_ADVANCED_AUDITING

P. 47

Advanced Auditing

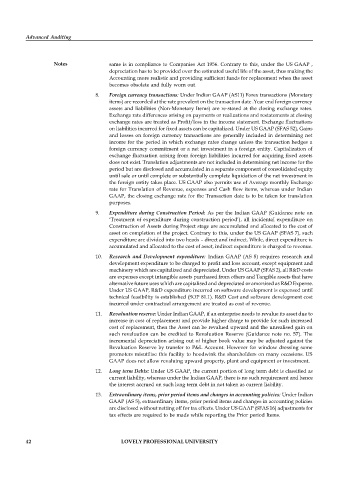

Notes same is in compliance to Companies Act 1956. Contrary to this, under the US GAAP ,

depreciation has to be provided over the estimated useful life of the asset, thus making the

Accounting more realistic and providing sufficient funds for replacement when the asset

becomes obsolete and fully worn out.

8. Foreign currency transactions: Under Indian GAAP (AS11) Forex transactions (Monetary

items) are recorded at the rate prevalent on the transaction date .Year end foreign currency

assets and liabilities (Non-Monetary Items) are re-stated at the closing exchange rates.

Exchange rate differences arising on payments or realizations and restatements at closing

exchange rates are treated as Profit/loss in the income statement. Exchange fluctuations

on liabilities incurred for fixed assets can be capitalized. Under US GAAP (SFAS 52), Gains

and losses on foreign currency transactions are generally included in determining net

income for the period in which exchange rates change unless the transaction hedges a

foreign currency commitment or a net investment in a foreign entity. Capitalization of

exchange fluctuation arising from foreign liabilities incurred for acquiring fixed assets

does not exist. Translation adjustments are not included in determining net income for the

period but are disclosed and accumulated in a separate component of consolidated equity

until sale or until complete or substantially complete liquidation of the net investment in

the foreign entity takes place. US GAAP also permits use of Average monthly Exchange

rate for Translation of Revenue, expenses and Cash flow items, whereas under Indian

GAAP, the closing exchange rate for the Transaction date is to be taken for translation

purposes.

9. Expenditure during Construction Period: As per the Indian GAAP (Guidance note on

‘Treatment of expenditure during construction period’), all incidental expenditure on

Construction of Assets during Project stage are accumulated and allocated to the cost of

asset on completion of the project. Contrary to this, under the US GAAP (SFAS 7), such

expenditure are divided into two heads – direct and indirect. While, direct expenditure is

accumulated and allocated to the cost of asset, indirect expenditure is charged to revenue.

10. Research and Development expenditure: Indian GAAP (AS 8) requires research and

development expenditure to be charged to profit and loss account, except equipment and

machinery which are capitalized and depreciated. Under US GAAP (SFAS 2), all R&D costs

are expenses except intangible assets purchased from others and Tangible assets that have

alternative future uses which are capitalised and depreciated or amortised as R&D Expense.

Under US GAAP, R&D expenditure incurred on software development is expensed until

technical feasibility is established (SOP 81.1). R&D Cost and software development cost

incurred under contractual arrangement are treated as cost of revenue.

11. Revaluation reserve: Under Indian GAAP, if an enterprise needs to revalue its asset due to

increase in cost of replacement and provide higher charge to provide for such increased

cost of replacement, then the Asset can be revalued upward and the unrealised gain on

such revaluation can be credited to Revaluation Reserve (Guidance note no. 57). The

incremental depreciation arising out of higher book value may be adjusted against the

Revaluation Reserve by transfer to P&L Account. However for window dressing some

promoters misutilise this facility to hoodwink the shareholders on many occasions. US

GAAP does not allow revaluing upward property, plant and equipment or investment.

12. Long term Debts: Under US GAAP, the current portion of long term debt is classified as

current liability, whereas under the Indian GAAP, there is no such requirement and hence

the interest accrued on such long term debt in not taken as current liability.

13. Extraordinary items, prior period items and changes in accounting policies: Under Indian

GAAP (AS 5), extraordinary items, prior period items and changes in accounting policies

are disclosed without netting off for tax effects. Under US GAAP (SFAS 16) adjustments for

tax effects are required to be made while reporting the Prior period Items.

42 LOVELY PROFESSIONAL UNIVERSITY