Page 168 - DCOM510_FINANCIAL_DERIVATIVES

P. 168

Unit 10: The Trader Workstation

To complete the spread transaction, the refiner buys back the crack spread by first Notes

repurchasing the heating oil futures he sold in May. Since they now trade at 163.7370/bbl,

they cost him 84¢/bbl. more than he sold them for. But he also sells back the crude oil

futures he purchased in May. Since crude oil futures are trading at $137/bbl. It earns him

$3.00/bbl. more than he paid for them.

His gain on the spread is therefore $ 3.16. It is calculated as $3.00 gain on crude oil futures

minus the 84¢ loss on heating oil futures. Had the refiner been unhedged, his margin

would have been limited to a gain of $ 26.74 gain he had in the cash market. Instead,

combined with that gain, his final net margin with the hedge is $28.9.

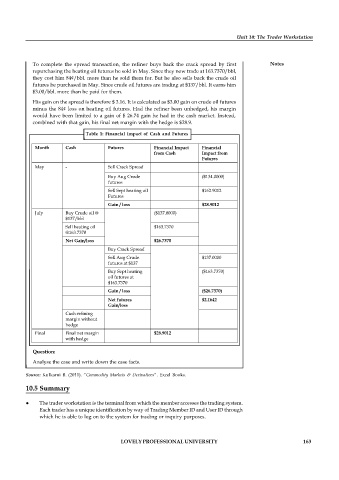

Table 1: Financial Impact of Cash and Futures

Month Cash Futures Financial Impact Financial

from Cash Impact from

Futures

May - Sell Crack Spread

Buy Aug Crude ($134.0000)

futures

Sell Sept heating oil $162.9012

Futures

Gain / loss $28.9012

July Buy Crude oil @ ($137.0000)

$137/bbl

Sell heating oil $163.7370

@163.7370

Net Gain/loss $26.7370

Buy Crack Spread

Sell Aug Crude $137.0000

futures at $137

Buy Sept heating ($163.7370)

oil futures at

$163.7370

Gain / loss ($26.7370)

Net futures $2.1642

Gain/loss

Cash refining

margin without

hedge

Final Final net margin $28.9012

with hedge

Question:

Analyse the case and write down the case facts.

Source: Kulkarni B. (2011). “Commodity Markets & Derivatives”. Excel Books.

10.5 Summary

The trader workstation is the terminal from which the member accesses the trading system.

Each trader has a unique identification by way of Trading Member ID and User ID through

which he is able to log on to the system for trading or inquiry purposes.

LOVELY PROFESSIONAL UNIVERSITY 163