Page 89 - DMGT409Basic Financial Management

P. 89

Basic Financial Management

Notes Contribution

DOL =

EBIT or Operating profit (EBIT)

4,00,000

Operating leverage = = 2.66

1,50,000

5.4.2 Financial Leverage

A firm may need long-term funds for long-term activities like expansion, diversifi cation,

modernization etc., the financial managers job is to compose funds. The required funds may be

raised by two sources: equity and debt. Use of various sources to compose capital is known as

financial structure. The use of fixed charges, sources of funds such as debt and preference share

capital along with the equity share capital in capital structure is described as fi nancial leverage.

Financial leverage results from the presence of fi xed fi nancial charges in the income statement.

Financial leverage associates with financing activities. The fixed charges do not vary with fi rm’s

EBIT. They must be paid regardless of the amount of EBIT available to the firm. It indicates the

effect on EBIT created by the use of fixed charge securities in the capital structure of a fi rm.

Financial leverage is computed by the following formula:

EBIT or operating profit

Financial (Leverage) =

EBT or taxable income

or

Percentage change in EPS

Degree of financial leverage (DFL) = Percentage change in EBIT

!

Caution A Financial leverage may be positive or negative. Favourable leverage occurs

when the firm earns more on the assets purchased with the funds, than the fixed cost of

their use and vice versa. High degree of financial leverage leads to high fi nancial risk.

Illustration 2: A firm has sales of 1,00,000 units at ` 10 pu. Variable cost of the produced products

is 60 per cent of the total sales revenue. Fixed cost is ` 2,00,000. The firm has used a debt of `

5,00,000 at 20 per cent interest. Calculate the operating leverage and fi nancial leverage.

Solution:

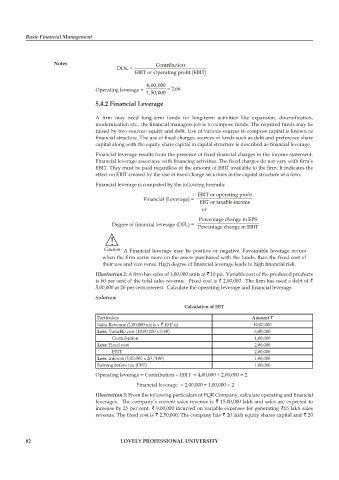

Calculation of EBT

Particulars Amount `

Sales Revenue (1,00,000 units x ` 10 P.u) 10,00,000

Less: Variable cost (10,00,000 x 0.60) 6,00,000

Contribution 4,00,000

Less: Fixed cost 2,00,000

EBIT 2,00,000

Less: Interest (5,00,000 x 20 /100) 1,00,000

Earning before tax (EBT) 1,00,000

Operating leverage = Contribution ÷ EBIT = 4,00,000 ÷ 2,00,000 = 2

Financial leverage = 2,00,000 ÷ 1,00,000 = 2

Illustration 3: From the following particulars of PQR Company, calculate operating and fi nancial

leverages. The company’s current sales revenue is ` 15,00,000 lakh and sales are expected to

increase by 25 per cent. ` 9,00,000 incurred on variable expenses for generating `15 lakh sales

revenue. The fixed cost is ` 2,50,000. The company has ` 20 lakh equity shares capital and ` 20

82 LOVELY PROFESSIONAL UNIVERSITY